Advanced Soltech's subsidiary in China, has signed two orders with

AnHui ShanLong Textile Technology Co. Ltd. and AnHui HuaChenShiJia Textile Technology Co. Ltd. Both companies have the same owner. The orders concern the installation of two solar energy plants of 2.24 and 0.65 megawatts (MW), and together they are estimated to generate annual revenues of approximately SEK 2.35 million, or approximately SEK 47 million during the agreements' 20-year term. The investment in the facilities, which will be owned by Advanced Soltech's wholly owned subsidiaries in China, amounts to approximately SEK 17.3 million and construction is planned to start in the third quarter of 2021. The projects achieve good profitability completely without subsidies and are located in Anhui province.

Advanced Soltech's CEO Max Metelius comments:

-Our sales organization continues to reap success in Anhui Province. It is especially fun to be able to deliver several good projects to the same customer. Our projects are robust and durable and have previously been tested by typhoons and now also by recent floods and storms, which has not led to any significant damage.

Advanced Soltech's subsidiary in China, has signed an order with FuJian Chuang Long Textile Co. Ltd. The order is for the installation of a solar energy plant of 1.78 megawatts (MW), which is estimated to generate annual revenues of approx. SEK 1.36 million, or approx. SEK 27.2 million during the agreement's 20-year term. The investment in the facility, which will be owned by Advanced Soltech's wholly owned subsidiaries in China, amounts to approximately SEK 10 million and construction is scheduled to start in the third quarter of 2021. The project achieves good profitability completely without subsidies and is in Fujian Province.

Advanced Soltech's CEO Max Metelius comments:

-Our sales team continues to reap success in Fujian Province. We are experiencing a growing interest in solar energy in China from both customers and other players.

Advanced Soltech's subsidiary in China, has signed an order with FuJian HaiShan Foods Co. Ltd. The order concerns the installation of a solar energy plant of 2 megawatts (MW), which is estimated to generate annual revenues of approx. SEK 1.52 million, or approx. SEK 30.4 million during the agreement's 20-year term. The investment in the facility, which will be owned by Advanced Soltech's wholly owned subsidiary in China, amounts to approx. SEK 11.2 million and construction is scheduled to start in the third quarter of 2021. The project achieves good profitability completely without subsidies and is in Fujian Province.

Advanced Soltech's CEO Max Metelius comments:

-We experience that companies increasingly see solar energy as a natural part of their energy supply. This particular customer is a large scale producer of canned vegetables for both the domestic and the international market.

Advanced Soltech's subsidiary in China, has signed an order with KunShan Chuho Spring Co. Ltd. The order concerns the installation of a solar energy plant of 1.0 megawatts (MW), which is estimated to generate annual revenues of approximately SEK 0.82 million, or approximately SEK 16.4 million during the agreement's 20-year term. The investment in the facility, which will be owned by Advanced Soltech's wholly owned subsidiary in China, amounts to approximately SEK 5.6 million and construction is planned to start in the third quarter of 2021. The project achieves good profitability without any subsidies and is located in Jiangsu Province.

Advanced Soltechs CEO Max Metelius comments:

-We are experiencing strong demand from both the private and public sectors. This customer is a well-established Japanese manufacturer of parts for the automotive industry that fits well into our customer portfolio.

Soltech Energy and Skanska Kommersiell Utveckling Norden have signed a letter of intent regarding collaboration on innovations for building-integrated solar energy solutions. Focus in the collaboration will be energy optimization of commercial properties. The initial ambition is to launch a joint pilot project within a two-year period.

The solar energy group Soltech and Skanska, which is one of Sweden's leading construction companies, has now started their innovation collaboration. It is Skanska Kommersiell Utveckling Norden, a wholly owned subsidiary who develops commercial properties, that has joined forces with the solar energy group. After signing the agreement both parties together will take a step further in their ambition to develop new building solutions with solar energy as the primary target.

– We see great value in merging our solar energy expertise with Skanska's expertise to create synergies where tomorrow's energy solutions are born. The emphasis will be on creating scalable overall solutions making commercial properties even more sustainable in the future. I want to thank Skanska for a good collaboration so far and look forward to breaking ground together, says Anna Svensson, Head of Innovation, Soltech Energy.

Leading actors working together for innovation

Soltech is a leading solar energy group in Sweden with 17 subsidiaries that develop, sell, install and optimize solar energy solutions for roofs and facades as well as charging and storage solutions. Soltech will now collaborate with one of the leading construction groups, Skanska, in the hunt for tomorrow's innovations.

– It feels exciting to be able to have Soltech with us when we create the foundation for our future innovations with the goal of finding even better and more sustainable solutions in our upcoming commercial real estate projects for the Nordic market. We have high goals and clear quality and environmental ambitions for everything we do. Therefore, it is important for us to have a competent partner with whom we can have a long-term collaboration on sustainable innovation. This is exactly what we have found in Soltech, says Henrik Ahnström, Director of Product, Process & Innovation

Eight residential buildings in Norra Biskopsgården will soon have solarpanels on their roofs. NP Gruppen, a Soltech subsidiary, has signed an agreement on a large solar energy solution with one of Sweden's largest municipal housing companies, Bostadsbolaget, The total order value amounts to SEK 6.5 million.

The solar energy group Soltech Energy has a transformation strategy which means that traditional roof, façade and electricity companies are acquired to the family and will add solar energy solutions to their business in order to meet both customers and environmental ambitions for green energy solutions. The strategy is ongoing and successful. Soltech's subsidiary, NP Gruppen has now signed a solar energy agreement with Bostadsbolaget, a non-profit housing company in Gothenburg. The agreement includes that NP Gruppen will build solar energy solutions on eight of Bostadsbolaget's properties in Norra Biskopsgården. Construction will start after the summer, and the solar energy facilities are expected to be completed later this year.

– It is with great pride that we can state that this project now goes from the drawing table to reality. This means that on all eight buildings we will integrate solar energy into people's everyday lives. Bostadsbolaget's ambitious sustainability goals and our solar energy solutions will now be a perfect match and we look forward to making Norra Biskopsgården a little greener together, says Marcus Juhlin, Solar energy manager at NP Gruppen.

Ferroamp balances the energy

In addition to the solar energy solution, a Ferroamp system will also be installed, to even out power peaks and to optimize electricity usage when it is needed the most and at the lowest cost. Oskar Scheiene, Energy Manager at Bostadsbolaget, looks with great confidence at the upcoming solar energy investment in the district.

– We are happy that we have signed on for our largest solar energy project to date. This is an investment that is completely in line with our ambitions to reduce Bostadsbolaget's climate footprint and increase our share of renewable energy. It is also an investment that fits well into a cityscape and environment where we want to highlight sustainability in every way. We are looking forward to work closely with NP Gruppen to turn the sun's rays into green energy in people's homes in Norra Biskopsgården, says Oskar Scheiene, Energy Manager at Bostadsbolaget.

XXL Sport and Vildmark will have a solar energy solution at their department store in Örebro. Soltech's subsidiary Swede Energy will construct and build a solar energy solution of a total of 2,000 m2 on the buildings flat roof. The construction will start at the end of 2021.

Swede Energy has a vast experience of building large roof-mounted solar energy solutions on logistics and retail properties. The company has now been commissioned by the Nordic region's largest sports chain, XXL, to build a roof-mounted solar energy solution at the XXL store in Örebro. The whole facility will measure 2,000 m2 and generate green energy for the department store's operation.

– It feels great that we now have cooperation with the Nordic region's largest sports chain, which clearly sees the value of green energy power. We are convinced that other chain stores will follow, as solar energy is an excellent alternative for property owners and store owners with ambitions to advance within sustainability, says Christoffer Caesar, CEO of Swede Energy.

Solar energy is the way forward for XXL

XXL is the Nordic region's largest sports chain and has 90 department stores in Norway, Sweden, Finland and Austria, of which 29 are located in Sweden. XXL has declared a sustainability strategy to reduce its carbon footprint by placing strict demands on external products that the chain sells, but also to continue its internal efforts for more solar energy.

– For XXL, sustainability is important at all levels and the solar energy solution at our department store in Örebro will be a clear step along the way. We have high demands on our sustainability efforts and solar energy is fully in line with our ambition to reduce our CO2 emissions by 55 percent by 2030. We are very much looking forward to our first solar cell plant in Sweden, says Anders Lindblom, CEO of XXL Sweden.

The tool manufacturer Speedtool can now fully operate its production facility in Habo, just north of Jönköping, with the help of solar energy. Soltech's subsidiary, Swede Energy, has installed nearly 2,000 m2 solarpanels for the tool manufacturer's roof. The facility was put into operation during the spring.

Soltech Energy's subsidiary Swede Energy has a vast experience of installing large solar energy solutions and has completed a nearly 2,000 m2 solar cell plant with an output of 352 kW on Speedtools property in Habo.

– Helping prominent, local companies finding the way to green solar energy is the type of projects that really make me proud. Speedtool has a long experience, and it feels very good to have been commissioned to install their solar energy solution. We are looking forward to being a part of their continued journey, says Rickard Lantz, Sales Manager at Swede Energy.

High-tech company with environmental ambitions

Speedtool was founded in 1997 and has clients in the automotive, aerospace, offshore, appliances and furniture industries. The company's production is situated in Habo, just north of Jönköping. Now Speedtool has become self-sufficient in energy thanks to the solar energy solution. The company's CEO, Jimmy Korsbeck, believes that one of the motivators for customer to choose supplier on, is the ability to install solar energy solutions.

– Sustainability investments are an important factor for us, showing both the surrounding world, our customers and all our fantastic employees that we not only talk but also act. The solar energy solution will help us operate our high-tech machinery in a climate-smart way. Something that benefits the company and the environment in both the short and long term, says Jimmy Korsbeck, CEO of Speedtool.

Swede Energy, a Soltech subsidiary, is building a large solar energy solution for the real estate company Emilshus and the tenant Bufab. The facility will cover most of the roof and will be in full operation during October 2021.

Swede Energy has a vast experience of installing large and complex solar energy solutions and has now received an order from the real estatator Emilshus of a 4,000 m2 of solar panels at the property in Värnamo, where the global trading company Bufab is the tenant.

– We are very proud to have received this assignment from Emilshus. It is a leading developer that clearly prioritize sustainability. The planned solar energy facility proves their green ambitions, and we are very much looking forward to ensuring that the tenant Bufab will be able to enjoy the rays of the sun in their future business, says Rickard Lantz, Sales Manager at Swede Energy.

Locally produced solar energy in Värnamo

The property is located in Värnamo, where Emilshus manages several properties. As part of the company's sustainability strategy, the tenant Bufab now will be supplied with green energy directly from the sun. Something that benefits both Emilshus and Bufab.

– Sustainability investments of this kind are completely right for us. Energy efficiency in our properties is important and it’s obvious that solar energy will help us in our sustainability efforts. We are grateful for the smooth collaboration with Swede Energy and look forward to our new solar energy solution, says Lisa Johansson, Sustainability Manager at Emilshus.

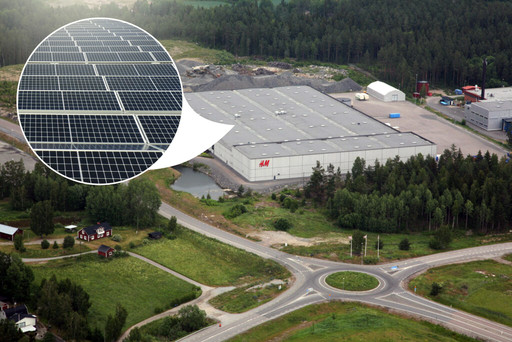

The collaboration between Soltech Energy and the real estate company Kilenkrysset is now strengthened. Soltech's subsidiary Swede Energy will build a solar energy solution at one of Kilenkrysset's logistics properties in Eskilstuna. The tenant H&M will thus have access to solar energy from the 1,200 m2 facility.

Soltech's subsidiary Swede Energy has a vast experience of installing solar energy solutions on large logistics and industrial property roofs. The building houses the central warehouse of the clothes and fashion company, H&M, tenant to real estator Kilenkrysset. The assignment applies to a roof-facility with an area of 1,200 m2.

– It feels great that Swede Energy gets the honor of installing what will be Kilenkrysset's new solar power solution. We already have a good relation and collaboration, which is now being strengthened. It is a property owner who clearly understands the importance of sustainable solutions and green energy in their properties, both from an economic and environmental perspective. That we also get renewed contracts shows their confidence in our way of working and is of course good proof that we do things right and create value for our customers, says André Nylén, Regional Manager at Swede Energy.

The third solar energy solution with Kilenkrysset

It’s not the first time the companies have collaborated. Swede Energy has previously built a solar energy solution for Kilenkrysset on the property Örnäs 1: 9 in Upplands-Bro, with tenant Ramirent and currently another plant is being built on a property in Jordbro, for future tenant Nybergs Deli. The solar cell plant in Eskilstuna will, when completed, produce and supply H&M with green energy.

– We are really looking forward to being able to continue making climate investments by increasing the use of green energy. The installation of the solar cell plant creates good conditions for our tenants and gives them the possibility to grow in a sustainable way. Kilenkrysset’s aim is to be a positive actor when it comes to green development solutions, and we are convinced that solar energy is the way forward for large property owners. In addition, it is extra fun to be able to continue the good collaboration we have built up together with Swede Energy, says Per Heikman, Head of Administration at Kilenkryset.