On June 27, Affärsvärlden published an article about Soltech that avoids mentioning anything positive at all about Soltech's development in recent years. The writer only has a negative focus instead of a holistic perspective. The article is full of examples of deals that have been challenging for various reasons and not a single successful acquisition or deal is mentioned. The article also has a long line of own interpretations, personal attacks, opinions and facts that are purely incorrect and unprofessional. Furthermore, I was not a shareholder who stepped in in 2019, I had been chairman of the board for 7 years. I’m also the single largest shareholder, so building a castle in the air is not directly in my interest.

Since we started our acquisition strategy in 2019, Soltech has expanded greatly and in such a strategy losses are a natural part initially. It is not possible to increase turnover fortyfold without investing large sums of money. We have never tried to hide the fact that, in addition to all the successes, we have of course encountered challenges.

My view of the media is that they often do a good job by analyze different companies, and there everything negative has to be highlighted. But the media should not focus solely on highlighting the negative aspects in a subjective article. In order to provide the reader, and our shareholders, an objective picture of the company, the positive should also be highlighted. But since this part was not included in Affärsvärlden's article, I thought I would highlight some of them in the following list:

• from 2019 to 2022, we have gone from approx. 50 MSEK to approx. 2,000 MSEK in turnover. The expansion continues with a focus on profitability

• our organic growth was as much as 57% in 2022 and 66% in Q1 2023. Proof that the subsidiaries thrive and develop within the Soltech Group

• our underlying business was profitable in both Q4 2022 and Q1 2023

• approx. 30 companies have been acquired and the absolute majority have had a very good development and over 95% of all entrepreneurs have stayed in the Group

• in 2022, Soltech was established in the Netherlands and Spain via the acquisition of large solar energy companies

• our investment in solar parks has proven very successful. Recently, a deal with Solgrid was communicated with an initial order value of SEK 700-1000 million

• synergy effects between the companies are beginning to have a noticeable effect both in terms of lower prices and safer deliveries

• The solar energy industry worldwide faces an extremely positive future as governments, businesses and individuals line up to ensure cheap and green energy.

Soltech's subsidiaries conducts a fantastic job and our idea with a solar energy company as a foundation and deep competence in nearby areas such as roofing, facade and electrical technology is a unique positioning that will deliver great value in the future.

I understand that our shareholders and employees are very worried after this article and I can only refer to the positive things within our Group, of which a small part is mentioned above. We continue to build a Group with a focus on quality, profitability and growth and look forward to other articles in the future that give an overall picture of Soltech Energy.

Stefan Ölander, CEO

Borlänge-based Soltech company E-Mobility and Kläppen Ski Resort are now collaborating. An agreement between the companies has been reached which awards E-Mobility the privilege of installing solar panels and smart electric vehicle (EV) charging points for the thousands of cabin owners at the ski resort and the corporate headquarters of Kläppen Ski Resort. The order is initially valued at SEK 14 million, but can potentially amount to SEK 24 million during the contract period.

E-Mobility is the Soltech Group company with expertise in large-scale EV charging points and charging infrastructure. The company has signed a three-year agreement with Kläppen Ski Resort, Sweden's largest family-owned ski resort with 38 slopes and 21 ski lifts.

The agreement, effective as of August this year, means that E-Mobility is offering the cabin owners at Kläppen the opportunity to install solar panels and EV charging points, where E-Mobility delivers technical consultation, installation and continual support. All installations are also prepared to accommodate energy storage in the future. The company will also install solar panels and EV charging points at the planned new headquarter of Kläppen Ski Resort, expected to be finished in 2025, which will house 55 employees and provide close to 100 EV charging points.

– We are very happy to have gained the trust of a ski resort that really puts its sustainability ambitions to the test. Now we look forward to rolling up our sleeves and helping Kläppen's cabin owners get access to both smart EV charging and solar energy solutions, says Maja Pettersson, responsible for solar energy at E-Mobility.

An important service for both the climate and cottage owners

Kläppen Ski Resort has high sustainability ambitions for its operations and has previously participated in several environmental projects. Now the ski resort is taking its sustainability work to the next level through the long-term collaboration with E-Mobility, which will help cabin owners interested in sustainability reduce their environmental impact.

– We think it is extremely important to think long-term and sustainably. Sustainability work must permeate all daily work, and with E-Mobility's solutions we continue in the right direction. For us, it is a natural part to think sustainably, both in the short and above all in the long term. We are a family-owned company and for us sustainability is part of our core values and our DNA. We want to develop the company and in the future hand over a sustainable facility to the next generation Eriksson, says Gustav Eriksson, CEO of Kläppen Ski Resort.

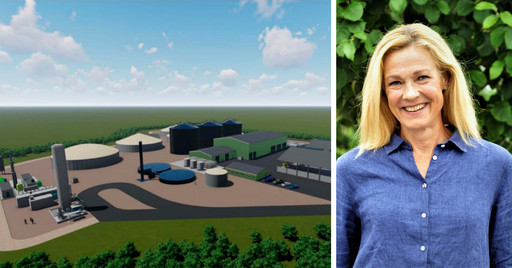

The Skara-based electrical engineering company Provektor has received an order from the Danish company Lundsby Renewable Solutions. Provektor will help develop a new biogas plant for Gasums in Götene. The project start is in June and the order value for Provektor amounts to just over SEK 20 million.

Provektor is Soltech's largest company within the electrical engineering industry and has deep expertise in electrical installations, automation, and solar energy. The company can be found at 13 different locations in Skaraborg, Skåne and Halland and currently has approximately 150 employees.

Provektor, together with Danish Lundsby Renewable Solutions, will carry out extensive electrical installations for what will become Gasum's new biogas plant. Biogas is a renewable and climate-friendly fuel. The facility in Götene will primarily use manure from the agricultural sector in the surrounding area as raw material.

The plant will produce 120 gigawatt hours (GWh) of liquefied biogas (LBG) yearly from 2025 onwards. This corresponds to the annual consumption of 300 trucks, or approximately 15,000 passenger cars that drive 1,500 miles. The biogas will be used as fuel for road transport, in the marine sector and in industry.

Elisabeth Nordberg, CEO at Provektor, is proud of the assignment and highlights a thorough feasibility study and competent employees as the key factors to win this assignment.

¬ We are proud and happy to have received this trust. It is an important project for us and the trust is a result of a genuine and thorough preliminary study and process, in which, among others, our experienced employees Andreas Werner, Albin Johansson and Erik Andersson have been a driving force. We are very much looking forward to getting started, says Elisabeth Nordberg, CEO at Provektor.

The Soltech Group's subsidiary, Soltech Energy Solutions, and the Norwegian solar park developer and investor Solgrid have entered a co-operation agreement where Solgrid becomes an investor and owner in several solar park projects that Soltech Energy Solutions will develop, install and operate. The ambition in the agreement is project developments for 300 MW of ground-mounted solar energy, which would mean a total investment of approximately SEK 2 billion for Solgrid if all applications are approved. County administrations and network owners decide on how many projects that will be approved, but the forecast for the initial order volume is total approx. SEK 700 million up to SEK 1 billion for Soltech Energy Solutions during the first 3-4 year period.

Soltech Energy Solutions is active within project development of large-scale solar energy solutions on roofs, ground and tech solutions for property owners and energy companies. The company has now entered into a cooperation agreement with the Norwegian solar park developer Solgrid, which invests mainly in land-based solar parks in Sweden together with Soltech Energy Solutions.

The agreement means that Solgrid will become the owner and investor of several solar parks that Soltech Energy Solutions designs, installs and operates in southern Sweden. Christoffer Caesar, CEO of Soltech Energy Solutions sees the agreement as a payoff for the company's project development focus.

– This project development agreement confirms the strategic movement we are making towards becoming a large-scale project developer that attracts investors that want to contribute to and accelerate the green transition. Solgrid is a highly competent partner who has seen the advantages in Sweden's solar energy conditions as well as in our quality processes and experience within the team, says Christoffer Caesar, CEO of Soltech Energy Solutions.

Major investment in locally produced electricity

The projects that Soltech Energy Solutions will design and develop for Solgrid are located in the so called electricity area SE4 and will be carefully evaluated based on existing infrastructure and where the solar parks can harmonize with natural and cultural values. Kristin Melsnes, CEO of Solgrid, is very positive about the investment and the long-term agreement with Soltech.

– It feels great that we are investing in more large-scale solar parks in Sweden. The solar energy conditions in southern Sweden are good and the local need for energy is large. Therefore, it feels safe that Soltech Energy Solutions is our partner in these type of solar park projects at a level that will strongly contribute to the local electricity supply, says Kristin Melsnes, CEO of Solgrid.

In a press release on 15 June at 08:45 AM, the wrong number of shares subscribed by Soltech Energy was stated. The correct number should be 6,027,889 pcs, not 39,640,390 pcs.

The board of Advanced Soltech Sweden AB (publ) has decided on June 14, 2023, as part of the company’s refinancing process, to carry out a targeted new share issue of approximately SEK 141 million. The directed new share issue is fully subscribed, but allocation is subject to the board’s approval. The main owners Soltech Energy Sweden AB (publ) and Advanced Solar Power Hangzhou Inc. have subscribed shares for a total amount of SEK 118.3 million. Soltech Energy has subscribed for 6 027,889 shares, a total investment of SEK 60.2 million.

Soltech Energy’s CEO Stefan Ölander comments:

“This is a very good opportunity for Soltech to invest in the world’s largest solar energy market at a low valuation. Yesterday’s announcement that JiangSu Leasing is investing approx. SEK 820 million in a sale and leaseback solution was very important due to Advanced Soltech’s situation with maturing bonds corresponding to almost SEK 1 billion at the beginning of July. Through this fully subscribed issue, the new financing solution is made possible, which means SEK 61 million in lower financing costs annually for Advanced Soltech. This will help them develop its business even further.”

Compensation issue in August to all shareholders in Advanced Soltech

The board of Advanced Soltech has also decided to carry out a compensation share issue of approximately SEK 99 million with the same subscription price (*10 SEK per share) as the directed new issue to compensate other shareholders for the dilution that the directed new issue entails.

Full participation in the event of a completed directed new share issue and compensation issue would mean a total addition of equity of approximately SEK 240 million.

Advanced Soltech’s CEO Max Metelius comments:

“With the new financing in place, consisting of a sale and leaseback financing agreement in China of approximately SEK 820 million supplemented by this targeted new issue, we have reduced interest costs, reduced the currency risk and created a stable financial platform that significantly improves the result. Now we can focus on growth again.”

Here is Advanced Soltech’s more extensive press release: https://advancedsoltech.se/investerare/pressmedalenden/

* SEK 10 corresponds to a volume-weighted average price for the Company’s share on the Nasdaq First North Growth Market during the last 10 trading days up to and including June 13, 2023 (“VWAP”) which amounts to SEK 9.98. The board therefore considers the subscription price to be market-based

The Board of Advanced Soltech Sweden AB (publ) has decided on June 14, 2023, as part of the company’s refinancing process, to carry out a directed new share issue of approximately SEK 141 million. The directed new share issue is fully subscribed, but allocation is subject to the Board’s approval. The principal owners Soltech Energy Sweden AB (publ) and Advanced Solar Power Hangzhou Inc. have subscribed shares for a total amount of SEK 118.3 million. Soltech Energy has subscribed for 39,640,390 shares, a total investment of SEK 60.2 million.

Soltech Energy’s CEO Stefan Ölander comments:

“This is a great opportunity for Soltech to invest in the world’s largest solar energy market at a low valuation. Tuesday’s announcement that JiangSu Leasing is investing approx. SEK 820 million in a sale and leaseback solution was very important due to Advanced Soltech’s situation with maturing bonds corresponding to almost SEK 1 billion at the beginning of July. Through this fully subscribed issue, the new financing solution is made possible, which means SEK 61 million in lower financing costs annually for Advanced Soltech. This will help them develop their business even further.”

Compensation issue in August to all shareholders in Advanced Soltech

The Board of Advanced Soltech has also decided to carry out a compensation share issue of approximately SEK 99 million with the same subscription price (*10 SEK per share) as the directed new issue to compensate other shareholders for the dilution that the directed new issue entails.

Full participation in the event of a completed directed new share issue and compensation issue would mean a total addition of equity of approximately SEK 240 million.

Advanced Soltech’s CEO Max Metelius comments:

“With the new financing in place, consisting of a sale and leaseback financing agreement in China of approximately SEK 820 million supplemented by this directed new issue, we have reduced interest costs, reduced the currency risk and created a stable financial platform that significantly will improve our result. Now we can focus on growth again.”

Here is Advanced Soltech’s more extensive press release: https://advancedsoltech.se/investerare/pressmedalenden/

* SEK 10 corresponds to a volume-weighted average price for the Company’s share on the Nasdaq First North Growth Market during the last 10 trading days up to and including June 13, 2023 (“VWAP”) which amounts to SEK 9.98. The board therefore considers the subscription price to be market-based

Advanced Soltech Sweden AB (publ) has entered into an agreement regarding a sale and leaseback financing of approximately SEK 820 million. The first part of the agreement covers approximately SEK 670 million for repayment of the SOLT5 secured bond. Once this has been completed, the remaining part of the agreement, which includes approximately SEK 150 million, will be completed. This part will be used for repayment of the SOLT2 and SOLT3 bonds in combination with the proceeds from a targeted new issue of approximately SEK 140 million, which the Company plans to carry out and in which Soltech Energy will participate. The Company estimates that the annual financing cost through the refinancing will decrease by SEK 61 million in relation to the financial year 2022 as the effect of the refinancing takes full effect.

Summary

Advanced Soltech Sweden AB (publ) and its relevant subsidiaries (the "Company"; the "Group" or the "Group Companies" depending on the context) have entered into an agreement with the Chinese company JiangSu Financial Leasing Co., Ltd. ("JiangSu Leasing") to be part of the refinancing of the Company's outstanding bonds. The financing is a so-called sale and leaseback financing that provides the Group with 541 MCNY (approximately SEK 820 million) ("sale and leaseback financing").

In addition and as part of the refinancing of the Company's outstanding bonds, the board has initiated a process aimed at carrying out a directed new share issue of approximately SEK 140 million based on the authorization from the annual general meeting on May 19, 2022. The refinancing through the sale and leaseback financing, and a successfully completed targeted new issue, is estimated to reduce costs by SEK 19 million on a quarterly basis compared to Q1 2023 and compared to the fiscal year 2022, costs will decrease by SEK 61 million on an annual basis.

Due to the refinancing process of the Company's outstanding bonds taking longer than expected, the Company has updated its financial target to reach 1 GW of installed capacity by 2026, from 2024 previously.

The company assesses that the current connected and revenue-generating installations of approximately 250 MW, supplemented by the completion of installations under construction of 41 MW, would under current conditions yield annual revenues of SEK 274 million.

CEO Stefan Ölander comments:

– It is great news for both Soltech Energy and Advanced Soltech that they are able to refinance their assets on favorable terms. The financing solution will significantly increase the their profitability, create good conditions for continued profitable growth and reduce the currency risk. It is obvious for us as a major owner to participate in the issue, which will strengthen the company and increase the value of our holding, says Stefan Ölander, CEO of Soltech Energy.

ASAB's CEO Max Metelius comments:

– The refinancing in China of the outstanding bonds is very positive. We will achieve lower interest and tax costs, while largely eliminating the currency risk. With the new financing, we have limited the requirement for security for the current financing, thereby creating a good financial platform to achieve our goal of 1 GW of installed capacity, while laying the foundation for continued profitable growth, comments Max Metelius, CEO, Advanced Soltech.

*JiangSu Leasing is one of China's major leasing companies, founded in 1985 and listed on the Shanghai Stock Exchange since 2018. The five largest owners are JiangSu Communications Holding Co Ltd (a provincial state-owned company that invests in infrastructure), Bank of Nanjing Co Ltd, Jangsu Yangtze Highway Bridge Co Ltd, BNP Paribas and the International Finance Corporation (part of the World Bank). For more information about JiangSu Leasing please see https://www.jsleasing.cn/en/.

Advanced Soltech's more extensive press release: https://advancedsoltech.se/investerare/pressmeddelanden/

Soltech company E-Mobility has entered into a charging agreement with Voltiva, which is a nationwide supplier of on-site electric car charging. The agreement states that E-Mobility will install thousands of charging points for commercial properties in Gävleborg, Uppsala, and Dalarna counties. The agreement extends over a five-year period and can amount to a total order value of SEK 58 million for E-Mobility.

E-Mobility is the Soltech Group's company with specialist expertise in large-scale electric car charging installations and highly efficient charging infrastructure. The company has now entered into an agreement with Voltiva, an operator in on-site electric charging, for up to 3,000 charging points in connection with both commercial properties and apartment buildings in several counties. As the growth of electric cars will continue to grow extensively in the next ten years, CEO Martin Götesson sees this type of agreement as important to be able to meet increased demand.

– This agreement will make a difference for many property owners in Gävleborg, Uppsala and Dalarna counties, which motivates us greatly. The fact that we also get to do it with Voltiva, who is a highly innovative partner, makes this even more interesting. We want to thank Voltiva for the trust and look forward to designing intelligent and powerful solutions for both property owners and their tenants, says Martin Götesson, CEO at E-Mobility.

Three million rechargeable passenger cars by 2030

The electric car market has grown rapidly over the past three years. Since 2020, the market has tripled and forecasts from Power Circle shows that Sweden will have around three million rechargeable passenger cars in 2030, compared to around half a million today.

Offering quality charging options will therefore become increasingly important and is already seen as a hygiene factor for commercial property owners. Not least since approximately 80–90 percent of charging sessions take place at home or at the workplace. Mikael Ring, CEO at Voltiva, sees long-term agreements like this as the way forward for the charging industry and an important factor for the green transition.

– The agreement with E-Mobility is the start of a long-term collaboration that will create great benefits for our customers and their customers. It is a very competent partner and the fact that we signed a longer agreement makes it possible for us to grow together. Now we will make sure to help the country's property owners to be better equipped for an electrified future, says Mikael Ring, CEO at Voltiva.

Takrekond in Växjö & Kalmar is one of the Soltech Group's roofing companies that has been transformed into a solar roof company. A transformation that has been successful as the company now offers both roofing and solar energy services to companies and private individuals. Takrekond has now received renewed trust from the property company Nyfosa to install a solar solution at one of their industrial properties in Växjö.

The Soltech Group's strategy to acquire and then develop and transform the acquired companies is successful. By adding solar energy expertise to the acquired companies in the roof, facade and electrical engineering industries, both competitive advantages are created but also a renewed offer that is appreciated by the companies' existing customers.

This was proven not least when the roofing company Takrekond in Växjö & Kalmar was trusted to help the real estate company Nyfosa with both roofing contracting and solar energy solutions during the past year. A trust that has now also resulted in another solar energy installation on one of Nyfosa's industrial properties in Växjö.

– We are very happy to have received renewed trust from Nyfosa, with whom we have had a good collaboration for a long time. This is a proof that we have hit the right spot with our solar energy development and are slowly but surely future proofing our business and creating sustainable solutions, says Nisse Jansson, CEO at Takrekond.

Half the turnover is from solar energy

Since Takrekond was acquired by Soltech Energy, turnover has tripled and approximately half of turnover today consists of solar energy services. Furthermore, Nisse Jansson is convinced that roofing companies that want to gain continued trust from previous customers, and also be attractive to new customers, must be able to offer a combination of roofing contracting and solar energy services.

– The implementation of solar energy knowledge has, to say the least, yielded good results for Takrekond, although of course there are challenges when a classic roofing company develops into also becoming a solar energy company. But the solar transformation is progressing strongly, and it is great when former roof customers of our companies now also get in touch to get help with solar installations, says Stefan Ölander, CEO of Soltech Energy.

Soltech company Annelunds Tak has won a new order. The company will carry out roofing and install a solar energy solution covering 2,700 square meters on what will become a new production facility in Nässjö. The assignment is to be carried out for the developer Byggarvid and the order value amounts to approximately SEK 14 million.

Soltech acquires and develops companies in the solar, roof, facade, and electrical technology industries. Through the Group's transformation strategy, solar energy is then added to the companies' core competencies.

This strategy has been successful for the Herrljunga-based roofing company Annelunds Tak, which is now a solar roofing company that offers both roofing contracting and solar energy installations. This is not least reflected in the turnover, which has more than doubled since the company started its solar energy focus and with good profitability. CEO Mikael Markusson and his team have now won another combined roof and solar energy deal.

– Projects, such as this, that include both solar and roofing demonstrate our strength in providing both services for our customers. We want to thank Byggarvid for the trust and look forward to developing a sustainable property together, says Mikael Markusson, CEO of Annelunds Tak.

BREEAM-SE* certification and solar

Annelunds Tak has an established and long going collaboration with Byggarvid, which is a construction company that carries out construction contracts, project development and housing and that has a stated ambition to build properties that move the society in a sustainable direction. The production facility in Nässjö will have an area of 22,000 square meters and will be environmentally certified according to BREEAM-SE level Excellent, whereupon a solar energy solution was a given choice.

– It feels good that we will develop a property with high environmental performance. We have had great cooperation with Annelunds Tak in the past, so it feels safe that they will help us with both roofing and the installation of a large solar energy solution, says Emanuel Elofsson at Byggarvid.

* BREEAM (BRE Environmental Assessment Method) is an environmental certification system from Great Britain, developed and administered by the Building Research Establishment (BRE). BREEAM is one of the oldest environmental certification systems and the system has been used to certify over 500,000 buildings. BREEAM has existed in revised versions since 1990 and is the most widespread of the international systems in Europe. Sweden Green Building Council has adapted BREEAM to Swedish conditions since 2013.