Annelunds Tak, one of the Soltech Group’s roofing companies, has signed an extensive contract to install 43,000 sqm of roofs on Jula’s large warehouse expansion in Skara. The agreement also includes an option for an additional 3,000 sqm and will be executed for the construction and property developer Skeppsviken Bygg i Skövde. The project will start in April.

Annelunds Tak offers complete solutions in roofing contracting, including sedum. Since its entry into the Soltech Group, the company has also developed into a full-range company where solar energy solutions, electric car charging and energy storage are also included in the company’s offering.

The company has extensive experience in roofing for logistics properties and other types of roofing contracts on low-pitched roofs. High quality materials included in the offer and skilled installers are crucial for both reliability and sustainability. Annelunds Tak has signed an agreement with Skeppsviken Bygg i Skövde to contribute to the new production of the extension part of Jula’s distribution center in Skara. The roofing that the company will carry out corresponds to an area of just over six full-size football pitches*.

Jula’s distribution center currently amounts to approximately 180,000 square meters and will grow to just over 220,000 square meters with this expansion.

“It feels fantastic and we are honored to be responsible for the roofing of the new production of Jula’s major logistics expansion. This is a project that really shows the strength of our offering and our capacity and we thank Skeppsviken Bygg i Skövde for the trust. We look forward to contribute in the project with our expertise and to deliver a high-quality project,” says Mikael Markusson, CEO of Annelunds Tak.

The project will start in April and Jula expects the warehouse expansion to be put into operation during 2026.

*Full-size football pitch estimated at 7,140 sqm

Photo: Soltech/Jula

The shareholders of Soltech Energy Sweden AB (publ), reg. no. 556709-9436, (the “Company”) are hereby invited to the extra general meeting on Tuesday, 17 March 2026 at 17:00 CET at the Company’s premises at Birger Jarlsgatan 41A in Stockholm. Please note that the registration begins at 16:30 CET.

Right to attend the extra general meeting and notice

Shareholders who wish to attend the general meeting must:

- on the record date, which is Monday 9 March 2026, be registered in the share register maintained by Euroclear Sweden AB (for nominee registered shares, also see below under the heading “Nominee registered shares”); and

- notify the Company of their participation and any assistants (no more than two) in the general meeting no later than Wednesday 11 March 2026. The notification shall be in writing to Baker & McKenzie Advokatbyrå KB, Attn: Filippa Kronsporre, Box 180, 101 23 Stockholm (kindly mark the envelope “Soltech extra general meeting 2026”), or via e-mail: filippa.kronsporre@bakermckenzie.com. The notification should state the name, personal/corporate identity number, shareholding, address and telephone number and, when applicable, information about representatives, counsels and assistants. When applicable, complete authorization documents, such as registration certificates and powers of attorney for representatives and assistants, should be appended the notification.

Nominee registered shares

Shareholders, whose shares are registered in the name of a bank or other nominee, must temporarily register their shares in their own name with Euroclear Sweden AB in order to be entitled to participate in the general meeting. Such registration (so-called voting rights registration), which normally is processed in a few days, must be completed no later than on Monday 9 March 2026 and should therefore be requested from the nominee well before this date. Voting registration requested by a shareholder in such time that the registration has been made by the relevant nominee no later than on Wednesday 11 March 2026 will be considered in preparations of the share register.

Proxy etc.

A shareholder who wishes to be represented by proxy shall issue a written and dated proxy to the proxy holder. If the proxy is issued by a legal entity, a certified copy of the registration certificate or corresponding document (“Registration Certificate“) shall be enclosed. The proxy must not be more than one year old, however, the proxy may be older if it is stated that it is valid for a longer term, maximum five years. The proxy in original and the Registration Certificate, if any, must be available at the general meeting and a copy should well before the meeting be sent to the Company by regular mail or by e-mail to the address above and should, in order to facilitate the entrance to the general meeting, be at the Company’s disposal no later than on Wednesday 11 March 2026.

A form proxy will be available on the Company’s website www.soltechenergy.com.

Proposed agenda

- Opening of the meeting and election of chairman of the meeting

- Preparation and approval of the voting list

- Approval of the agenda

- Election of one or two persons to certify the minutes

- Examination of whether the meeting has been duly convened

- Determination of the number of board directors, board remuneration, election of the board of directors and election of chairman to the board

- Closing of the meeting

Proposition for resolution

Item 1: Opening of the meeting and election of chairman of the meeting

The nomination committee proposes that Carl Svernlöv, attorney at law, Baker McKenzie, is appointed as chairman of the extra general meeting.

Item 6: Determination of the number of board directors, board remuneration, election of the board of directors and election of chairman to the board

The nomination committee proposes that the board of directors shall consist of six directors.

The nomination committee does not propose any changes to the board fees resolved by the annual general meeting 2025, which shall remain unchanged. Fees to the newly elected board members, should they be elected, shall therefore be paid in the same amount, pro rata for the term of office until the next annual general meeting.

The nomination committee proposes the election of Petteri Saarinen and Joachim Zetterlund as new board members, and that Ivana Stankovic and Bernt Ingman resign from their duties on the board. Furthermore, it is proposed that Petteri Saarinen be elected as chairman of the board.

The nomination committee also proposes that Stefan Ölander, Ove Anebygd, Jacob Langhard-Rosencrantz and Thomas Mejdell remain as board members.

If the extra general meeting resolves in accordance with the submitted proposals, Nordic Capital and Stefan Ölander have agreed that the 18‑month lock‑up undertaking provided by Stefan Ölander to Nordic Capital in connection with the divestment of Sesol and the completion of the rights issue, as communicated on 4 July 2025, shall be terminated.

More information regarding the proposed elected directors:

Name: Petteri Saarinen

Education: Master of Science from Aalto University and Teknillinen korkeakoulu-Tekniska högskolan.

Current assignments: Petteri Saarinen is currently a board member and chairman of the board, as well as chairman of the remuneration committee and a member of the finance & audit committee, of ProGlove and Autocirc Group AB. He also serves as chairman and chief executive officer of Endeco Group Oy. In addition, he is an industrial advisor to Nordic Capital.

Previous assignments (a selection):

- Board member and Chair of the board of Oy Verman Ab, 2019–2024.

- Board member of Consilium AB, 2020–2024.

- Chief Executive Officer of LEDiL Group Oy, 2019–2024.

- Board member of Dalan Animal Health, Inc., 2020–2022.

Year of birth: 1967

Nationality: Finnish

Shareholding, including closely related parties: No

Independence: Petteri Saarinen is deemed to be independent in relation to the Company and management, and dependent in relation to major shareholders.

___

Name: Joachim Zetterlund

Education: Institute for advanced marketing and education (IHM) and Scandinavian Total Institute of Business (STIB).

Current assignments: Joachim Zetterlund is currently a board member of Allurity AB and FörlagsSystem JAL AB as well as board member and member of the finance and audit committee of LOQ Oy.

Previous assignments (a selection):

- Board member and chairman of the board and the remuneration committee of One Agency Sweden AB, 2017–2021.

- Board member and member of the remuneration committee of Xpeedio Support Solutions AB, 2008–2020.

- Board member, member of the compensation committee and member of the finance and audit committee of Quant AB, 2015–2019.

- Board member, chair of the compensation committee and member of the risk committee of Munters Group AB, 2012–2019.

Year of birth: 1963

Nationality: Swedish

Shareholding, including closely related parties: No

Independence: Joachim Zetterlund is deemed to be independent in relation to the Company, management and major shareholders.

The nomination committee’s complete proposal and motivated opinion as well as further information regarding the proposed directors are available at the Company’s website www.soltechenergy.com.

Number of shares and votes

The total numbers of shares and votes in the Company on the date of this notice are 1,322,793,927. The Company holds no own shares.

Other

The complete proposals, proxy form and other documents that shall be available in accordance with the Swedish Companies Act are available at the Company premises, Birger Jarlsgatan 41A, 111 45 Stockholm, and at the Company’s website, www.soltechenergy.com, at least two weeks in advance of the general meeting and will be sent to shareholders who request it and provide their e-mail or postal address.

The shareholders are hereby notified regarding the right, at the extra general meeting, to request information from the board of directors and managing director according to Ch. 7 § 32 of the Swedish Companies Act.

Processing of personal data

For information on how personal data is processed in relation the meeting, see the Privacy notice available on Euroclear Sweden AB’s website: https://www.euroclear.com/dam/ESw/Legal/Privacy-notice-bolagsstammor-engelska.pdf.

______________________________

Stockholm in February 2026

Soltech Energy Sweden AB (publ)

The board of directors

Strategic review of the consumer market

COMMENTS FROM THE CEO

In 2025, we have taken major strategic steps and implemented extensive measures with the aim to strengthen Soltech’s position in order to continue adapting the business to the current market situation. Our main focus is to build a profitable and long-term resilient group. At the same time, the year has been characterized by a difficult market situation.

A number of non-recurring effects have had a significant impact on the quarter, primarily in the form of write-downs within the framework of the strategic review and restructuring in our business area solar for consumers. At the same time, we see that our business areas roofing, electricity and façade in general are showing a more stable and positive development.

Completed rights issue and a new major shareholder

The completed and fully guaranteed rights issue of approximately SEK 329 million was one of the year’s most important strategic measures to strengthen the Group financially. In connection with the issue, Nordic Capital became our largest shareholder. Their industrial expertise and long-term perspective give Soltech better conditions going forward. The issue also enables an acceleration of our work with profitability measures and the development of existing business areas.

Continued work on profitability-driving measures

During the year, as previously mentioned, we implemented a number of profitability-driving initiatives within the Group, organizational changes as well as cost reductions. These measures will strengthen our resilience and improve our position even in a challenging market environment. We have a clear focus on what we can influence, and this is a work that we will pursue in a structured way at all levels and in all operations in the Group with continued discipline.

Stable core operations create security

During the year, our core roof, façade and electrical technology businesses contributed stability and constituted important building blocks in the Group. With broad and deep expertise and continuous adaptation to the market situation, these businesses have continued to create stability and, not least, value for their customers, which consist of commercial property owners, the public sector and industries.

Strategic review of the consumer market in solar energy

During the autumn and fourth quarter, we have been working on a strategic review of the Group’s solar energy business specifically in the consumer market. Due to a continued weak consumer market, decisions have been made on a number of strategic measures in our companies that have only been aimed at the consumer market. These measures meant that Sesol in Norway and Soldags in Sweden were declared bankrupt as they were not considered viable. Sesol in Sweden went into reconstruction at the same time, and our previous company 365zon in the Netherlands was sold back to the founders.

The reconstruction of Sesol in Sweden is proceeding after intensive preliminary work. So far, the reorganization shows that the business has the potential to continue to operate after restructuring with an adapted organization and cost structure, as well as new processes that create an even more focused and clear platform.

Scale and complete solutions

Despite the challenging market, we are seeing positive signals. We are seeing a recovery in demand in our various business areas for major installations and contracts, which contributes to security in a turbulent time. Improved interest rates also create better conditions for faster investment decisions in the construction sector and industry, which is expected to have positive effects in the long term.

I would like to extend a big and warm thank you to all employees, customers and shareholders. This has been a year that has required flexibility, hard work and difficult decisions. I am proud of how we have come through an intense and challenging period together to continue to drive the business forward.

Patrik Hahne, CEO

Read the CEO’s comment in full in the report

QUARTER 4: 1 OCTOBER – 31 DECEMBER*

- Net sales amounted to SEK 565.5 (638.4) million. The Group’s organic growth amounted to -32% (-18%)

- EBITDA, adjusted for operations subject to strategic review and adjusted for non-cash flow impacting non-recurring effects related to revaluations and impairments, amounted to SEK -17.9 (12.2) million

- EBITDA amounted to SEK -80.4 (22.7) million. EBITDA margin was -14.2% (3.6%). EBITDA was impacted by revaluation effects of SEK 15.0 (25.2) million.

- EBITA, adjusted for operations subject to strategic review and adjusted for non-cash non-recurring effects related to revaluations and impairments, amounted to SEK -32.1 (-8.3) million

- EBITA amounted to SEK -122.4 (1.6) million. EBITA margin was -21.6% (0.2%). EBITA was impacted by revaluation effects of SEK 15.0 (25.2) million. Excluding revaluations, EBITA amounted to SEK -137.4 (-23.9) million.

- Profit after tax for the period amounted to SEK -345.7 (-171.0) million and was negatively impacted by depreciation and amortization of SEK -243.4 (-117.9) million

- Cash flow from operating activities amounted to SEK -11.7

(96.0) million. Cash flow for the period amounted to SEK 116.8 (121.8) million - Earnings per share before and after dilution amounted to SEK -0.46 (-1.29)

FULL YEAR JANUARY 1 – DECEMBER 31*

- Net sales amounted to SEK 1,709.3 (2,260.9) million. The Group’s organic growth amounted to -32% (-20)

- EBITDA, adjusted for operations subject to strategic review and adjusted for non-cash flow impacting non-recurring effects related to revaluations and impairments, amounted to SEK -43.6 (-12.8) million

- EBITDA amounted to SEK -145.9 (39.9) million. EBITDA margin was -8.5% (1.7%). EBITDA was impacted by revaluation effects of SEK 15.0 (91.3) million

- EBITA, adjusted for operations subject to strategic review and adjusted for non-cash non-recurring effects related to revaluations and impairments, amounted to SEK -103.1 (-77.3) million

- EBITA amounted to SEK -237.9 (-27.3) million. EBITA margin was -14.0% (-1.2%). EBITA was impacted by revaluation effects of SEK 15.0 (91.3) million. Excluding revaluations, EBITA amounted to SEK -252.9 (-118.6) million

- Profit after tax for the period amounted to SEK -501.3 (-289.3) million and was negatively impacted by depreciation and amortization of SEK -301.2 (-211.3) million

- Cash flow from operating activities amounted to SEK -161.2 (75.8) million. Cash flow for the period amounted to SEK 9.6 (17.9) million

- Earnings per share before and after dilution amounted to SEK -1.31 (-2.19)

Significant events during the quarter

- A rights issue was completed, which provided the company with proceeds of SEK 329 million before issue costs

- The Nomination Committee for the Annual General Meeting on May 20, 2026 has been appointed

- Soltech acquired an additional 34.7 percent of the shares in the Spanish subsidiary SUD Renovables. After the transaction, Soltech owns 99.7 percent and the remaining 0.3 percent continues to be owned by the founders. The acquisition was financed from own cash

- Soltech’s Spanish subsidiary SUD Renovables signed an agreement with Banco Sabadell for the development of three new solar parks with a total capacity of 35 MWp. The solar parks are planned to be commissioned in 2026. The order value amounted to approximately SEK 203 million and in addition to this, a seven-year operation and maintenance agreement worth SEK 7.7 million was also signed

- The Board of Directors decided to sell back the shares in the Dutch company 365zon to the minority shareholders. The business is presented as a business held for sale

Significant events after the quarter

- Soltech has decided on structural changes for the Group’s subsidiaries that operate in the consumer market in the form of reconstruction, bankruptcy and liquidation for the Sol-consumer companies in Sweden and Norway, as well as a sale of the shares in the Dutch company. This has been motivaded by a continued weak and challenging market situation in the consumer market for solar energy. This means that the fourth quarter of 2025 will be affected by non-cash non-recurring effects linked to impairment of assets and excess values in affected units. It also means that the subsidiary in the Netherlands 365zon is treated as a business held for sale

The rest of the Group in electrical engineering, façade, roofing and large-scale solar energy installations, based on current operations and ongoing initiatives, is judged to be at or on its way to profitable and cash flow positive levels, and this is where the Group’s focus is going forward. In these areas, we see a brightening ahead with profitability improvements. Margins are affected by implemented cost-cutting measures and are starting to yield positive results

*Soltech sold the shares in the Dutch company on January 29, 2026. The business is presented as a business held for sale and is not included in Net sales, EBITDA and EBITA. Comparison periods have been adjusted. For further information, see note 11. Net sales, EBITDA and EBITA in the report include businesses in consumer solar that have been declared bankrupt, liquidated and restructured after the turn of the year.

The quarterly report and other financial reports are available at: https://soltechenergy.com/en/investors/financial-reports-calendar/

On April 1, 2022, Soltech Energy acquired 53.3 percent of the of the subsidiary 365zon in the Netherlands, 365zon Energie Holding B.V. Soltech has had a binding option to acquire the remaining 46.7 percent. The cost for exercising this option was set at approximately SEK 30 million with settlement during the first quarter of 2026. The Board of Directors has decided to sell Soltech’s share back to the minority owners of the company for EUR 1 instead. The solar energy market in the Netherlands has declined sharply in recent years and the Board’s assessment is that the subsidiary 365zon and the solar energy market in the Netherlands will have a long recovery time. Soltech further assesses that 365zon will need shareholder support to continue to run the business long-term. In the near term, Soltech prioritizes profitability and to turn the Group towards profitability in 2026, preserving cash and allocating capital to the business areas that have the highest potential for positive value growth.

Soltech acquired 53.3 percent of 365zon in April 2022 with a binding option to acquire the remaining 46.7 percent. The cost for exercising this option was set at approximately SEK 30 million. When the acquisition was completed in 2022, the consumer market in solar energy was very strong and 2023 was a record year. In 2024 and 2025, the consumer market deteriorated sharply in the Netherlands, mainly due to regulatory changes but also to a weaker macroeconomic climate. As a result, 365zon has rapidly declining profitability and Soltech believes that the company will have a long recovery time. Until then, the assessment is also that the company needs additional shareholder support. The sale of Soltech’s share in the subsidiary enables a saving of liquidity (partly the option and partly additional shareholder support) and that the management can focus on the rest of the operations within the Group, which are considered to have higher potential for positive value development for Soltech’s shareholders.

– For a couple of years, the solar energy market has been challenging, and we are now implementing a wide range of measures to turn the Soltech Group back into the black figures. We believe in 365zon in the long term, which is led by a competent local team, but we must act here and now, and then we believe that it is more important to maintain liquidity in the Group and avoid large outflows in the near future, says Patrik Hahne, CEO of Soltech Energy.

Comments on the decision on structural changes announced on 23 January

On January 23, the Board of Directors of Soltech announced that the Group is implementing several structural changes for the subsidiaries in solar energy for private individuals in Sweden and Norway as well as a review of the presence in the Netherlands. The divestment of 365zon in the Netherlands, together with other communicated structural changes in the subsidiaries in solar energy for private individuals, will now have several different effects.

A full report will be published in the year-end report that will be released on February 19, 2026. Some of the effects are described below:

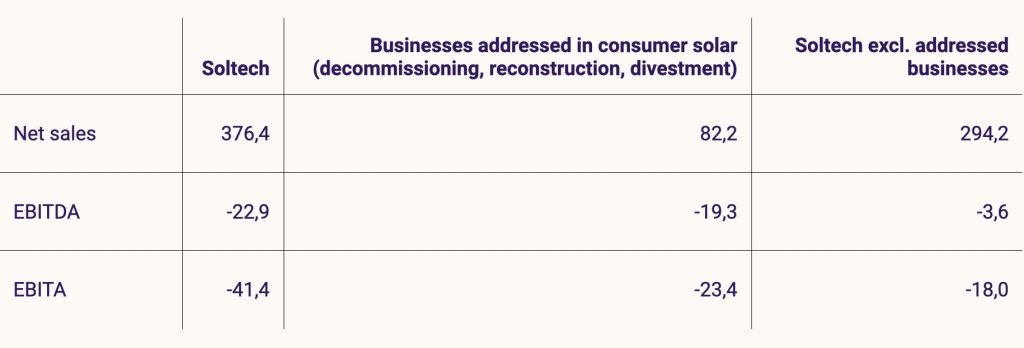

The Soltech Group’s earnings will be positively impacted by the announced structural changes in the consumer market and the sale of Soltech’s share in the subsidiary 365zon. Reported earnings excluding these parts are shown as follows. The businesses addressed are expected to be unprofitable overall in the fourth quarter as well.

The table below shows Q3 figures in MSEK

Screenshot

In addition to this, Soltech continues to implement several activities and initiatives to reduce the cost base, including organizational changes, reduction of fixed costs and efficiency improvements. These activities and initiatives will begin to be realized in the first half of 2026. In addition to this, Soltech also conducts several initiatives to increase sales and marketing.

The sales of Soltech’s share in the subsidiary 365zon is expected to contribute to an impairment need of SEK 143 million, which will affect the result for the fourth quarter, but will at the same time reduce the option debt by approximately SEK 44 million and have a positive impact on earnings in the fourth quarter.

Soltech assesses that the remaining cash in the Group is sufficient to meet the Group’s ongoing operations and commitments to customers, suppliers and employees for the foreseeable future.

Soltech Energy Sweden AB (publ) informs that the Board of Directors has today decided on structural changes for the Group’s subsidiaries that operate in the consumer market in the form of reconstruction, bankruptcy or liquidation for the companies in Sweden and Norway, as well as a review of the presence in the Netherlands. This is due to the continued weak and challenging market situation in the consumer market for solar energy. The rest of the Group’s business areas, electrical engineering, façade, roofing and large-scale solar installations, are close to, or near positive cash flow levels based on current operations and ongoing initiatives. Following the capital injection in October 2025, the Group maintains a solid liquidity position to support our subsidiaries in other business areas. The Board therefore considers these measures necessary to achieve positive cash flow more quickly.

The consumer market for solar energy has been challenging in recent years. In early 2026, the market situation has weakened as a result of recent global events, the effects of which are already affecting households’ willingness to invest in the short term, and slows down the demand. Therefore, there is no clear increase in demand going forward, this has led the Group to review the consumer business as a whole and decide on various measures.

Reconstruction of Sesol AB and bankruptcy of Sesol AS

Since the acquisition of Sesol was completed in the autumn of 2025, a business plan has been developed with the aim to change the negative economic situation and finding a way forward to create a profitable continuation for Sesol’s operations in the consumer market.

The work has entailed, among other things, cutbacks in premises, staff and geographical coverage. Measures have also been taken in processes, sales, purchasing and inventory. The forecasts for 2026 have recently had to be revised based on a weakened market situation and increased global instability. The long-term effect of the changes implemented in the business is not considered to be sufficient to achieve profitability. Sesol has a strong position in the market and a professional team of employees. In other words, there are good opportunities to create a profitable company from Sesol, but the cost base is currently too large to bear.

Therefore, the decision to request a company reorganization, in accordance with the Lag (2022:964) om företagsrekonstruktion, of Sesol AB in Sweden has been made by the company’s and Soltech Energy’s Board of Directors. Attorney Niklas Emthén, Lindskog Malmström Advokatbyrå AB, has been proposed as Restructuring officer.

The company reorganization will investigate the possibilities of conducting a future profitable business in the consumer company Sesol AB.

Sesol AS in Norway is not considered to have the prerequisites to become profitable and therefore the board of directors of the company and the board of Soltech Energy have made the decision to put the company into bankruptcy.

Bankruptcy and liquidation in Soldags

The subsidiary Soldags i Sverige AB will, following the decision of the Board of Directors today, be filed for bankruptcy as the conditions do not exist to run the business profitably. Bankruptcy trustees are appointed by the district court. At the same time, a voluntary liquidation of Soldags Montage AB (a subsidiary of Soldags i Sverige AB) is planned.

Review in the Netherlands

Over the past two years, the consumer market for solar energy in the Netherlands, has been characterized by regulatory uncertainty and political decisions that have resulted in a weaker demand and a significant change for the country’s solar energy companies. The conditions for solar energy have therefore weakened significantly compared to when Soltech established itself on the market. Therefore, a review is also being made of Soltech’s presence in the consumer market in the Netherlands, which is conducted in the part-owned company 365zon.

“The market in solar energy for private individuals has been developing slower than expected for a long time, and we see that the recovery is delayed. Therefore, through these measures, we choose to act and take responsibility for creating a profitable group,” says Patrik Hahne, CEO of Soltech Energy.

The solar tech company Takorama Elteknik continues to strengthen its position in advanced energy solutions and has signed an agreement with Trelleborgs Hamn for the design and installation of an energy storage facility of 4 MWh. The initiative is a central part of the port’s efforts to increase its level of self-sufficiency and to meet upcoming EU requirements for shore-side electricity supply (shore power) for larger vessels.The energy storage facility is expected to be commissioned in 2026.

In recent years, Takorama Elteknik has broadened its offering to include solar energy, energy storage, electrical installations and advanced electrical technology, a holistic approach that makes the company well positioned for large and complex energy projects. By combining technical expertise with a clear focus on sustainability, the company helps customers future-proof their businesses.

The energy storage facility to be installed for Trelleborgs Hamn will bring several benefits in the transition to more sustainable and efficient operations. By storing energy at low usage and at a lower price and then using it when larger ships connect to shore power, the port can smoothly handle power peaks and at the same time relieve the electricity grid. The solution also strengthens the port’s degree of self-sufficiency and contributes to significant reductions in emissions when diesel generators are replaced by clean electricity from shore.

Upcoming EU regulations place demands on ports Energy

Energy storage is expected to be a central component in the electrification that European ports are implementing to meet future requirements. The new EU regulations, which will come into force in 2030, mean that ships over 5,000 gross tons must connect to shore power at quayside.

“We are pleased to be entrusted with this project, which is a strategically important investment and shows how ports can take active responsibility for the energy supply. Trelleborgs Hamn is at the forefront and is doing something that many others will also need to do to meet future EU requirements for shore power and sustainable operations. We look forward to delivering a solution that combines high technical quality with concrete climate benefits” says Mikael Johansson, CEO of Takorama Elteknik.

Photo: Trelleborgs Hamn

In August, Soltech Energy completed the acquisition of the solar energy company Sesol AB, which became the Group’s 20th subsidiary. An integration work was started together with Soltech’s existing companies towards the consumer market with the goal of creating a unified offering under one and the same brand. In line with this objective, a decision was also made during the autumn to transfer the subsidiary Soldags to Sesol, which took effect on 1 January 2026. Now the integration work is completed and Sesol is changing its brand to Soltech Home, although the legal company name Sesol AB remains as a contracting party.

The business transition means that all staff from Soldags will now become part of Sesol. In addition to the staff being moved, all external communication and sales from Sesol will take place under the Soltech Home brand, which was launched by the Soltech Group in 2024. This creates a unified brand for the consumer market that positions Soltech as one of Sweden’s largest energy partners for households.

“When we acquired Sesol, the ambition was to create a strong and unified offering for the consumer market. We are doing this now that Sesol becomes Soltech Home, which is a strategic investment that gives us a clear profile and makes it easier to meet households’ needs for smart, profitable and sustainable solutions. We create a common culture, efficient processes and a customer experience that stands for quality and security. With a strengthened Soltech Home, we are taking an important step towards consolidating our position in a fast-moving market,” says Patrik Hahne, CEO of Soltech Energy.

Optimization of energy production

With Sesol as part of Soltech Home, the Group aims to build a profitable consumer business in 2026 and in the longer term reach an even larger market share. The focus is on more installations, subscription services and new products that strengthen customers’ independence and reduce energy costs. The concept offers needs-adapted solar energy solutions with associated batteries and electric car charging in combination with AI-based smart control that enables reduced energy costs for private individuals.

“We are proud to now be fully integrated into the Soltech Group. We get a brand that stands for innovation, future-proof energy solutions and a strong customer focus. Our employees and I look forward to continuing to develop our offering under the Soltech Home brand. This is the start of a long-term journey where we will create value for customers and the Group together. I would also like to warmly welcome Soldags employees to Sesol,” says Henrik Eriksson, CEO of Sesol.

Summary

- The acquisition of Sesol was completed in August and Sesol became the Soltech Group’s 20th subsidiary.

- The integration work has been ongoing during the autumn with a focus on common processes, culture and brand strategy.

- Sesol begins to operate under the Soltech Home brand in all external communication and sales

Soltech’s Spanish subsidiary Sud Renovables has signed an agreement with the leading financial entity Banco Sabadell to develop three new agrivoltaic solar parks with a total capacity of 35 MWp. The parks are planned to be commissioned during 2026. The order value for the solar parks and batteries amounts to approximately SEK 203 million, and in addition, a seven-year operation and maintenance agreement worth SEK 7.7 million has also been signed.

The project consists of agrivoltaic land-based solar parks that enable combined energy production and agriculture. An agrivoltaic system is a combination of agricultural activities and photovoltaic parks. The solar panels are more sparsely installed than in other solar parks, which makes it possible for agriculture to harvest even on the land on which the solar panels stand.

In addition to the solar panels, associated batteries will also be installed for the solar parks. Part of the revenue will be reported in 2025, which will contribute positively to the company’s earnings. However, most of the revenue is expected to come in 2026.

“Sud Renovables continues to deliver at the highest level. This project shows technical competence, business acumen and the ability to build long-term relationships with their customers. We are proud to have them in the Soltech family and I would like to congratulate Alfred, Manel and their entire solar park team who made this possible,” says Patrik Hahne, CEO of Soltech Energy.

Operating in Catalonia and the Balearic Islands

Sud Renovables, based north of Barcelona, is a leading solar energy company in Spain and became part of the Soltech Group in 2022. The company has about 90 employees and specializes in solar energy and storage solutions for both companies and individuals.

The company’s projects include everything from large-scale solar facades and roof-mounted facilities to floating installations and solar roofs for parking lots. The company has, among other things, installed the Balearic Islands’ largest floating solar cell plant in Mallorca.

“This is a deal we have been working on for a long time, and the fact that it is now in place feels fantastic. We look forward to delivering solar parks with agrivoltaic systems – where the solar energy solution enables both energy production and agriculture on the same surface – combined with battery storage. It is a technologically advanced solution that provides the customer with maximum benefit and enables long-term returns,” says Alfred Puig, CEO of Sud Renovables.

On 11 December, Soltech Energy Sweden AB (publ) signed an agreement to acquire an additional 34.7 percent of the shares in the Spanish subsidiary Sud Renovables. This means that Soltech Energy now owns 99.7 percent of the company. The remaining 0.3 percent is still owned by the founders of the company. Sud Renovables, with approximately 90 employees, had sales of approximately SEK 120 million in 2024. The acquisition is financed from own cash.

The Spanish solar energy company Sud Renovables, which became part of the group when Soltech acquired 65 percent of the shares in 2022, is active in solar energy and storage solutions for commercial and industrial customers’ self-consumption of solar energy and energy storage.

Soltech’s acquisition of the shares is made in accordance with previous option agreements. Soltech now owns 99.7 percent of Sud Renovables, following an agreement with the founders that they will retain 0.3 percent of the company going forward. At the same time, a new option agreement has been signed to enable Soltech to own 100 percent in the future when and if needed to satisfy Soltech’s interests.

“We are very pleased to acquire nearly the entire remaining stake in Sud Renovables. With a focus on quality, impressive innovation and a strong driving force, they are an important part of the Group and an industry leader in solar energy and energy storage in Spain. It is extra great that the founders Alfred, Manel and Angél want to continue to be owners and now we will jointly take the company to the next level, says Patrik Hahne, CEO of Soltech Energy.

Offering a wide variety of energy solutions

Sud Renovable’s projects often consist of large-scale roof-mounted solar systems, solar facades, solar roofs for parking lots, solar parks and floating solar installations on rainwater collection ponds.

The company was founded in 2005, is well established in Catalonia and has since 2022 been a valued part of the Soltech Group. The company will now have additional opportunities to continue its work to develop the energy solutions of the future that create value for both the customer and the climate.

“We value being part of Soltech Energy and now we are given even better opportunities to further develop our offering and continue to deliver high quality to our customers. Now we and our employees look forward to continuing the journey together with Patrik, Oscar, the rest of the team at Soltech and our sister companies in Sweden and the Netherlands, says Alfred Puig, CEO of Sud Renovables.

In the autumn of 2025, Soltech company Takorama Elteknik completed a large-scale energy project for a property owner in Borås. The project now contributes to the property being energy-optimized and streamlined in line with upcoming EU requirements for the energy performance of properties. Through the project, Takorama shows how their broad service portfolio including advanced electrical technology, energy storage, electrical installations, EV charging, roofing and solar energy helps property owners to future-proof their property portfolios with a focus on optimization and increased climate performance.

Takorama Elteknik has been part of Soltech since 2020 and has gradually broadened its offering to offer solar energy solutions in addition to roof contracting. In 2023, the company made an add-on acquisition of the electrical engineering company Din Elkontakt, changed its name to Takorama Elteknik and developed the business into a full-service company with a complete comprehensive offering in roofing, solar energy, energy storage and electrical engineering. This has broadened the offering, created new business opportunities and delivered greater value for the company’s customers.

In this project, Takorama Elteknik has been the turnkey contractor and helped the property owner with everything from analysis to designing, delivering and installing a number of energy solutions. The company has installed switchgear, high-voltage service and a transformer station, laid waterproofing with additional insulation so that the roof will contribute to increasing the property’s energy efficiency.

The project also includes an energy storage facility of 1.5 MW, which, together with over 2,000 solar panels with a total output of approximately 1 MW, creates efficient and favorable energy production. Takorama Elteknik has also installed electric car charging and carried out other electrical installations in the property.

– We are very proud to be able to deliver a solution that optimizes the customer’s property’s energy. Our responsibilities span everything from energy storage to electrical installations, roofing, solar energy and switchgear. By actively broadening our offering, we can take a holistic approach to real estate’s energy optimization and efficiency. Something that meets the customers’ needs from both an energy perspective but also from an operational economic perspective when we can contribute to creating business benefits for the customer, says Mikael Johansson, CEO of Takorama Elteknik.