THIS PRESS RELEASE MAY NOT BE MADE PUBLIC, PUBLISHED OR DISTRIBUTED, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, THE UNITED KINGDOM, AUSTRALIA, BELARUS, HONG KONG, JAPAN, CANADA, ISRAEL, NEW ZEALAND, RUSSIA, SWITZERLAND, SINGAPORE, SOUTH AFRICA, SOUTH KOREA, OR ANY OTHER JURISDICTION WHERE SUCH DISTRIBUTION WOULD REQUIRE PROSPECTUS, REGISTRATION OR OTHER MEASURES IN ADDITION TO THOSE REQUIRED BY SWEDISH LAW, IS PROHIBITED, OR OTHERWISE IS UNLAWFUL OR CANNOT BE MADE WITHOUT THE APPLICATION OF AN EXEMPTION FROM SUCH ACTION. REFER TO THE SECTION “IMPORTANT INFORMATION” AT THE END OF THIS PRESS RELEASE.

The board of directors of Soltech Energy Sweden AB (publ) (“Soltech”, the “Company” or the “Group”) has today resolved, subject to the approval of an extraordinary general meeting, to carry out a fully guaranteed rights issue of approximately SEK 329 million with preferential rights for the Company’s existing shareholders (the “Rights Issue”). The purpose of the Rights Issue is to strengthen the Company’s financial position, develop existing business areas, accelerate synergy effects and profitability-driving measures.

As part of the ongoing consolidation of the solar energy industry, Soltech identified an opportunity in the spring of 2025 to acquire Sesol, a leading Swedish company in the sale and installation of solar energy solutions to private individuals. On 4 July 2025, Soltech announced that the Company had entered into an agreement to acquire Sesol. The acquisition was carried out by Soltech, as payment for the shares in Sesol, resolving to issue new shares to Nordic Capital[1] (“Nordic Capital”) as the seller of the shares in Sesol (the “Consideration Share Issue”). The acquisition of Sesol was completed and closed on 26 August 2025. Through the Consideration Share Issue, Nordic Capital became the owner of approximately 30 percent of the outstanding shares and votes in Soltech, thereby becoming its largest shareholder.

The Rights Issue in brief:

- The Rights Issue comprises not more than 1,133,823,366 new shares in the Company.

- The subscription price has been set at SEK 0.29 per new share, resulting in total issue proceeds of approximately SEK 329 million before transaction costs.

- Those who are registered as shareholders in Soltech on the record date for the Rights Issue, on 2 October 2025, and who are entitled to participate in the Rights Issue, will receive one (1) subscription right for each existing share. One (1) subscription right entitles the holder to subscribe for six (6) new shares.

- The subscription period runs from and including 6 October 2025 up to and including 20 October 2025, or the later date resolved upon and announced by the board of directors.

- The Rights Issue is conditional upon approval at an extraordinary general meeting scheduled to be held on or around 30 September 2025.

- Nordic Capital has undertaken to subscribe for its pro rata share of the Rights Issue corresponding to approximately SEK 99 million and has also provided a guarantee commitment of an additional SEK 50 million. Soltech has in addition, through Swedbank’s aid, secured guarantee commitments for the remaining part of the issue amount in the Rights Issue. The Rights Issue is thus fully guaranteed.

- Nordic Capital, which holds approximately 30 percent of the total number of shares and votes in Soltech, has undertaken to vote in favour of the approval of the Rights Issue and amendment of the share and share capital limits in the Company’s articles of association to carry out the Rights Issue at the extraordinary general meeting scheduled to be held on or around 30 September 2025.

- By reason of the rights issue, the company will prepare an information document in accordance with Article 1.4 (db) of Regulation (EU) 2017/1129 of the European Parliament and of the Council (the “Prospectus Regulation”). The information document will be prepared in accordance with the requirements of Appendix IX to the Prospectus Regulation and will be published by the Company before the start of the subscription period. The information document is expected to be published on or around 1 October 2025.

Background and motives and use of issue proceeds

Soltech is a Swedish company operating in the solar energy industry with expertise in solar energy, electrical engineering, facade and roofing contracting, charging infrastructure and advanced energy storage solutions with integrated smart control systems. In 2019, the Company initiated an expansion, primarily through acquisitions of companies within these industries. The Company’s strategy was to acquire both sales and installation companies within solar energy and companies with a natural connection to this business, with expertise in areas such as roof renovations, electrical installations and facades. The strategy resulted in significant expansion for the Company, and the Group’s turnover increased from around SEK 50 million to a high of SEK 2.9 billion in 2023. However, the solar energy market declined in 2024 and Soltech’s financial position declined as the Company consolidated its resources ahead of a new phase in the solar energy market. This new phase is characterised by a changed market where energy storage has become more important, and Soltech foresees significant opportunities for growth and for taking a leading role in the transition.

The purpose of the Rights Issue is to strengthen the Company’s financial position and develop existing business areas, accelerate synergy effects and profitability-driving measures. Upon full subscription in the Rights Issue, the Company will receive net proceeds of approximately SEK 329 million before transaction costs. The net proceeds are intended to be used for the following purposes:

• Develop existing business areas, approximately 20 percent

• Accelerate synergy effects, approximately 25 percent

• Profitability-driving measures, approximately 20 percent

• Refinancing of loans and debts, approximately 15 percent

• Acquisitions, approximately 20 percent

Subscription undertakings and guarantee commitments

Nordic Capital has undertaken to subscribe for its pro rata share of the Rights Issue corresponding to approximately SEK 99 million and has also provided a guarantee commitment of an additional SEK 50 million. Soltech has in addition, through Swedbank’s aid, secured guarantee commitments for the remaining part of the issue amount in the Rights Issue. The Rights Issue is thus fully guaranteed.

For the guarantee commitments, excluding Nordic Capital’s guarantee commitment, a cash compensation of ten (10) percent of the guaranteed amount will be paid. For Nordic Capital’s guarantee commitment, a cash compensation of five (5) percent of the guaranteed amount will be paid. No compensation will be paid for Nordic Capital’s commitment to subscribe for its pro rata share of the Rights Issue. The subscription undertaking and guarantee commitments are not secured by bank guarantees, restriced funds, pledges or similar arrangements.

Terms and conditions for the Rights Issue

The board of directors of Soltech has today resolved, subject to the approval of an extraordinary general meeting, to carry out a fully guaranteed rights issue of approximately SEK 329 million with preferential rights for the Company’s existing shareholders, whereby those who on the record date of 2 October 2025 are registered in the share register maintained by Euroclear Sweden AB as shareholders in Soltech will receive one (1) subscription right for each share held in Soltech. The subscription rights entitle the holder to subscribe for new shares with preferential right, whereby one (1) subscription right entitles the holder to subscribe for six (6) new shares. In addition, the possibility is offered to subscribe for shares without subscription rights.

The new shares in Soltech are issued at a subscription price of SEK 0.29 per new share, which corresponds to a discount to the theoretical share price after separation of subscription rights (so called “TERP discount”) of approximately 35.5 percent based on the volume-weighted average price of the Soltech share for the period 15-28 August 2025. No brokerage fee is payable. The Rights Issue will thus raise approximately SEK 329 million for Soltech before transaction costs.

The existing shares are traded including the right to receive subscription rights up to and including 30 September 2025, and the first day of trading of shares excluding the right to receive subscription rights is 1 October 2025. The subscription period runs from and including 6 October 2025 up to and including 20 October 2025. Soltech’s board of directors has the right to resolve to extend the subscription period, which, when applicable, will be announced through a press release as soon as possible after such a resolution has been made.

In the event that not all shares are subscribed for with support of subscription rights, the board of directors shall, within the limits for the maximum amount of the Rights Issue, resolve on allotment of shares subscribed for without support of subscription rights (i.e., without preferential right), whereby allotment shall be made in the following order. First, to those who have subscribed for shares with support of subscription rights, regardless of whether or not the subscriber was a shareholder on the record date for the Rights Issue, and in the event of oversubscription, pro rata in relation to the number of shares subscribed for with support of subscription rights, and to the extent that this is not possible, by drawing lots. Secondly, to those who have subscribed for shares without subscription rights, and in the event of oversubscription, pro rata in relation to the number of shares notified for such subscription in the notification, and to the extent that this is not possible, by drawing lots. Thirdly, to certain shareholders and other stakeholders who have entered into guarantee commitments, pro rata in relation to the respective guarantors’ guaranteed amount, and to the extent that this is not possible, by drawing lots.

Through the Rights Issue, Soltech’s share capital may increase by not more than SEK 56,691,168.30, from SEK 9,448,528.05 to not more than SEK 66,139,696.35. The number of shares in the Company may increase by not more than 1,133,823,366, from 188,970,561 shares to not more than 1,322,793,927 shares, which corresponds to a dilution of approximately 85.7 percent of the total number of shares and votes in the Company for existing shareholders who elect not to participate in the Rights Issue. Shareholders who elect not to participate in the Rights Issue have the possibility to fully or partially compensate themselves financially for the dilution effect by selling their subscription rights. Subscription rights that are not exercised for subscription must be sold within the trading period specified below in order not to expire without value.

Preliminary timetable for the Rights Issue

| 30 Sep 2025 | Extraordinary general meeting to resolve on the approval of the Rights Issue and amendment of the share and share capital limits in the Company’s articles of association to carry out the Rights Issue |

| 30 Sep 2025 | Last day of trading in Soltech shares including the right to receive subscription rights |

| 1 Oct 2025 | First day of trading in Soltech shares excluding the right to receive subscription rights |

| 1 Oct 2025 | Estimated date for publication of information document for the Rights Issue |

| 2 Oct 2025 | Record date for the Rights Issue, i.e. shareholders registered in the share register on this date will receive subscription rights |

| 6–15 Oct 2025 | Trading in subscription rights |

| 6–20 Oct 2025 | Subscription period |

| 6–29 Oct 2025 | Trading in paid subscribed shares (Sw. Betalda tecknade aktier) |

| 21 Oct 2025 | Announcement of preliminary outcome of the Rights Issue |

| 23 Oct 2025 | Announcement of final outcome of the Rights Issue |

Information document

In connection with the Rights Issue, the Company will prepare an information document in accordance with Article 1.4 (db) of the Prospectus Regulation. The information document will be prepared in accordance with the requirements of Appendix IX to the Prospectus Regulation and will be published by the Company before the start of the subscription period. The information document with the full terms and conditions is expected to be published on or around 1 October 2025 and will be available on Soltech’s website www.soltechenergy.com.

Lock-up undertakings

In connection with the transaction, Nordic Capital has entered into a lock-up undertaking, with customary exceptions, regarding the shares subscribed for in the Consideration Share Issue and the shares being subscribed for in the Rights Issue. The commitment is valid for 18 months from and including 26 August 2025 which was the day of the completion of Nordic Capital’s divestment of Sesol. Stefan Ölander (Chairman), Patrik Hahne (CEO), Niclas Lundin (CFO) and Oscar Nelson (COO) have entered into substantially similar undertakings, with customary exceptions, regarding their respective shareholdings in Soltech and intend to participate in the Rights Issue.

Exemption from mandatory bid obligation

Nordic Capital has, through the ruling AMN 2025:27, been granted an exemption from the mandatory bid obligation that could arise from Nordic Capital subscribing for shares in Soltech in the Consideration Share Issue and participating in the Rights Issue with its pro rata share and possibly fulfilling its guarantee commitment. The exemption is conditional upon the shareholders of Soltech prior to the respective general meetings that will resolve on the Consideration Share Issue to Nordic Capital and the Rights Issue being informed of the maximum amount of capital and voting rights that Nordic Capital can receive through the participation in the Consideration Share Issue and the participation in the Rights Issue with its pro rata share and possibly fulfilling its guarantee commitment, and that the resolution of the general meetings is supported by shareholders representing at least two-thirds of the both the votes cast and the shares represented at each meeting, excluding shares held and represented at each meeting by Nordic Capital.

Extraordinary general meeting

The Rights Issue is subject to approval at an extraordinary general meeting of Soltech, which will be convened separately and is scheduled to be held on or around 30 September 2025. Nordic Capital, which holds approximately 30 percent of the total number of shares and votes in Soltech, has undertaken to at the extraordinary general meeting vote in favour of the approval of the Rights Issue and amendment of the share and share capital limits in the Company’s articles of association to carry out the Rights Issue.

Advisors

Swedbank AB (publ) is acting as Sole Global Coordinator and Bookrunner and Snellman Advokatbyrå AB is acting as legal advisor in connection with the Rights Issue.

For information, please contact:

Patrik Hahne, CEO, Soltech Energy Sweden AB

E-mail: patrik.hahne@soltechenergy.com

Phone: 073- 518 51 66

Important information

The release, announcement or distribution of this press release may, in certain jurisdictions, be subject to restrictions. The recipients of this press release in jurisdictions where this press release has been published or distributed shall inform themselves of and follow such legal restrictions. The recipient of this press release is responsible for using this press release, and the information contained herein, in accordance with applicable rules in each jurisdiction. This press release does not constitute an offer, or a solicitation of any offer, to buy or subscribe for any securities in Soltech in any jurisdiction, neither from Soltech nor from someone else.

This press release is not a prospectus for the purposes of Regulation (EU) 2017/1129 (the “Prospectus Regulation”) and has not been approved by any regulatory authority in any jurisdiction. In connection with the Rights Issue, the Company will prepare an information document in accordance with Article 1.4 (db) of the Prospectus Regulation. The information document will be prepared in accordance with the requirements of Appendix IX to the Prospectus Regulation and will be published by the Company before the start of the subscription period.

This announcement does not identify or suggest, or purport to identify or suggest, the risks (direct or indirect) that may be associated with an investment in the Company. The information contained in this announcement relating to the Rights Issue is for background purposes only and does not purport to be full or complete. No reliance may be placed for any purpose on the information contained in this announcement or its accuracy or completeness. Swedbank AB (publ) (“Swedbank”) is acting for Soltech in connection with the Rights Issue and no one else and will not be responsible to anyone other than Soltech for providing the protections afforded to its clients nor for giving advice in relation to the Rights Issue or any other matter referred to herein. Swedbank is not liable to anyone else for providing the protection provided to their customers or for providing advice in connection with the Rights Issue or anything else mentioned herein.

This press release does not constitute or form part of an offer or solicitation to purchase or subscribe for securities in the United States. The securities referred to herein may not be sold in the United States absent registration or an exemption from registration under the US Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold within the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There is no intention to register any securities referred to herein in the United States or to make a public Rights Issue of the securities in the United States. The information in this press release may not be announced, published, copied, reproduced or distributed, directly or indirectly, in whole or in part, within or into the US, the United Kingdom, Australia, Belarus, Canada, Hong Kong, Israel, Japan, New Zeeland, Russia, Singapore, South Africa, South Korea, Switzerland or in any other jurisdiction where such announcement, publication or distribution of the information would not comply with applicable laws and regulations or where such actions are subject to legal restrictions or would require additional registration or other measures than what is required under Swedish law. Actions taken in violation of this instruction may constitute a crime against applicable securities laws and regulations.

In the United Kingdom, this document and any other materials in relation to the securities described herein is only being distributed to, and is only directed at, and any investment or investment activity to which this document relates is available only to, and will be engaged in only with, “qualified investors” (within the meaning of the Prospectus Regulation as it forms part of domestic law in the United Kingdom by virtue of the European Union (Withdrawal) Act 2018) who are (i) persons having professional experience in matters relating to investments who fall within the definition of “investment professionals” in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (ii) high net worth entities falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). In the United Kingdom, any investment or investment activity to which this communication relates is available only to, and will be engaged in only with, relevant persons. Persons who are not relevant persons should not take any action on the basis of this press release and should not act or rely on it.

Forward-looking statements

This press release contains forward-looking statements that reflect the Company’s intentions, beliefs, or current expectations about and targets for the Company’s and the Group’s future results of operations, financial condition, liquidity, performance, prospects, anticipated growth, strategies and opportunities and the markets in which the Company and the Group operates. Forward-looking statements are statements that are not historical facts and may be identified by words such as “believe”, “expect”, “anticipate”, “intend”, “may”, “plan”, “estimate”, “will”, “should”, “could”, “aim” or “might”, or, in each case, their negative, or similar expressions. The forward-looking statements in this press release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurances that they will materialize or prove to be correct. Because these statements are based on assumptions or estimates and are subject to risks and uncertainties, the actual results or outcome could differ materially from those set out in the forward-looking statements as a result of many factors. Such risks, uncertainties, contingencies and other important factors could cause actual events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. The Company does not guarantee that the assumptions underlying the forward-looking statements in this press release are free from errors and readers of this press release should not place undue reliance on the forward-looking statements in this press release. The information, opinions and forward-looking statements that are expressly or implicitly contained herein speak only as of its date and are subject to change without notice. Neither the Company nor anyone else undertake to review, update, confirm or to release publicly any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this press release, unless it is required by law or Nasdaq First North Growth Market’s rule book for issuers.

[1] Through the company controlled by Nordic Capital, Artim Balance BidCo AB, which is ultimately owned by Nordic Capital Fund XI. Nordic Capital Fund XI refers to Nordic Capital Fund XI Limited, which acts as general partner for Nordic Capital XI Alpha, LP and Nordic Capital XI Beta, LP, together with related investment companies.

In recent years, Soltech’s subsidiary Soltech Energy Solutions has developed an offering in large-scale ground-based solar parks and associated batteries. The potential for the company’s total project portfolio with solar park projects and batteries amounts to over 2,000 MWp. The County Administrative Board has now granted approval for more than 100 MWp of new solar park projects.

Earlier this year, the milestone of 600 MWp of solar park projects gaining legal force was reached. Soltech intends to divest the rights to these projects, as well as possibly also carry out the construction of the solar parks for the investors. Now another milestone has been reached as the total number of permitted solar projects increased during the quarter. A total of over 700 MWp of solar park projects, with associated 170 MW large-scale batteries, have now been legally approved with the County Administrative Board.

“ We are pleased to announce that we have been granted permits for more than an additional 100 MWp of solar park projects, including associated large-scale battery storage. The fact that the team at Soltech Energy Solutions has developed a competitive hybrid offering with both solar parks and batteries enables both large-scale renewable electricity production and the necessary stabilization of the electricity grid,” says Patrik Hahne, CEO of Soltech Energy.

The solar park process

The process of developing and building a solar park involves several steps. Initially, the identification and analysis of the area’s solar radiation, proximity to electricity infrastructure and any natural and cultural interests will be carried out, as well as lease agreements with landowners. After that, in-depth investigations are carried out on the suitability of the site, which then results in a 12:6 notification of consultation to the County Administrative Board. In the next step, the County Administrative Board will decide whether the solar park may be built on the site. After that, detailed design begins and finally construction begins.

Hybrid solutions with solar park and battery

The development of Soltech’s offering containing solar park and batteries in the same facility is a hybrid solution that is growing in importance. Hybrid plants, with both solar park and batteries, involve the production of renewable electricity but also energy storage at the same plant. This enables a wider range of markets and services, such as smart control, monitoring and optimization, that the plant can utilize, thus enabling improved profitability of the projects. The combination also supports the electricity grid with frequency-regulating services that help maintain the necessary balance. Batteries are therefore an important complementary technology in the development of solar park projects.

Batteries that are erected in connection with solar parks, like solar parks, also require approval from the county administrative board through a 12:6 notification. Batteries also require a building permit and other tests before they are possibly erected in connection with solar parks.

Soltech company E-Mobility has now completed a new high-tech charging station for Qstar, which includes four fast charging stations of 400 kW respectively, smart control, transformer and monitoring services. The installation is now an important part of Qstar’s investment in electric charging for heavy traffic and also in the development of the charging infrastructure in the region.

Society and its various sectors are being electrified, and industries are transitioning their vehicle fleets. Changing consumption patterns and stricter regulatory requirements for charging infrastructure demand that the industry think long-term and innovatively to develop offerings and new business models. Soltech company E-Mobility is at the forefront of creating solutions that meet both new requirements as well as the growing and evolving needs of customers and society for smart charging infrastructure.

The company’s extensive experience in creating smart and high-quality charging solutions makes them a leading player within the Swedish charging infrastructure industry. E-Mobility has now completed a charging station for Qstar in Sundsvall. The investment is part of the effort to meet the increasing demand for electric transport solutions, with a particular focus on heavy traffic.

The new charging station is an advanced hub for electric trucks, equipped with four fast chargers with an output of 400 kW and a smart control system to optimize power and monitoring. E-Mobility is responsible for the entire project’s design, project planning and transformer solutions, electrical engineering, installation and commissioning.

“This is not just a charging station, but a complete energy hub. With 400 kW chargers, fast and efficient charging stops are possible. We are grateful for the trust from Qstar, a company that makes a significant contribution to the region’s charging infrastructure,” says Martin Götesson, CEO of E-Mobility.

Qstar invests in charging infrastructure

In recent years, Qstar has intensified its sustainability work with the goal of reducing the climate impact of the transport sector. By investing in charging infrastructure for both passenger cars and heavy vehicles, the company wants to contribute to the transition towards fossil-free transports.

“This investment is one of many important steps in our work to enable the transition. We want to create sustainable solutions for the transport of the future and offer our customers access to powerful and reliable charging – regardless of vehicle type,” says Ann-Sofi Karlsson, Business Developer at Qstar.

The acquisition of Sesol strengthens Soltech’s market position

CEO comment:

Through the acquisition of Sesol and with Nordic Capital as the new majority owner, we are now taking a decisive step in our journey towards becoming the leading player in solar energy and energy storage in Sweden with the power, breadth and expertise required to accelerate the energy transition.

However, the quarter was characterised by increased global uncertainty and the generally weak economy. This has led to longer decision-making times and increased competition as a result of fewer projects. The work of adapting the business is ongoing and although we have come a long way, there is still a lot of work to be done. The long-term need for solar energy, energy storage and charging infrastructure remains large and plays an important role in the energy and climate transition, and it is important for us to not only adapt to the current situation but also ensure that we are well equipped when the market turns.

The Group’s net sales in the second quarter decreased compared with the same period last year, which is an effect of a weak solar market and a cautious construction market. The lower activity in the quarter had a negative impact on the Group’s net sales, earnings and cash flow during the period. Work on cost adjustments and profitability enhancing measures is still ongoing and overall we have a positive effect of these measures, but which do not fully compensate for the reduced volume. Adjusted for revaluation effects, EBITDA amounts to SEK –45 million for the first 6 months of the year, which can be compared to SEK –44.1 million in the corresponding period last year.

The results show that we still have a lot of work to do, not only on cost adjustment and efficiency, but also on how and what we sell to our customers. Even though we have adjusted costs, I am far from satisfied with what we have achieved. We must continue to work on profitability-driving measures and our full focus is on accelerating and strengthening the activities that are continuously taking place to adapt the operations to the current market situation.

Through the planned and fully guaranteed Rights Issue of SEK 335 million (before transaction costs) and the acquisition of Sesol, we strengthen our financial position. It contributes to stability and, in the long run, competitive advantages for the Group’s subsidiaries to act as long-term and secure business partners for their customers.

With new financial conditions and a strong principal owner in Nordic Capital, we have both the expertise and the resources required to be able to continue to develop existing business areas, accelerate synergy effects and implement the necessary change work to meet tomorrow’s need for smart total solutions.

Patrik Hahne, CEO

Read the CEO’s comment in its entirety in the quarterly report.

Quarter 2: 1 April-30 June

- Net sales amounted to SEK 386.2 (620.2) million

- The Group’s organic growth amounted to -37% (-16)

- EBITDA amounted to SEK -29.1 (50.1) million. EBITDA margin amounted to -7.5% (8.1)

- EBITA amounted to SEK -44.7 (34.3) million. EBITA margin was -11.6% (5.5). EBITA was impacted by revaluation effects of SEK 0.2 (56.9) million. Excluding revaluations, EBITA amounted to SEK -44.9 (-22.6) million

- Profit after tax for the period amounted to SEK -57.0 (6.1) million.

- Cash flow from operating activities amounted to SEK -16.6 (24.0) million. Cash flow for the period amounted to SEK -5.3 (-68.4) million

- Earnings per share before and after dilution amounted to SEK -0.43 (0.05)

Interim period: 1 January-30 June

- Net sales amounted to SEK 832.4 (1,133.3) million

- The Group’s organic growth amounted to -26% (-21)

- EBITDA amounted to SEK -39.5 (49.5) million. EBITDA margin amounted to -4.7% (4.4)

- EBITA amounted to SEK -71.0 (19.2) million. EBITA margin was -8.5% (1.7). EBITA was impacted by revaluation effects of SEK 5.5 (93.6) million. Excluding revaluations, EBITA amounted to SEK -76.5 (-74.4) million

- Profit after tax for the period amounted to SEK -104.8 (-26.0) million

- Cash flow from operating activities amounted to SEK -92.2 (64.0) million . Cash flow for the period amounted to SEK -117.0 (-23.1) million

- Earnings per share before and after dilution amounted to SEK -0.79 (-0.20)

Significant events during the quarter

- Roof contract for 4,500 sqm on the new station building Göteborg Grand Central with an order value of approximately SEK 13 million

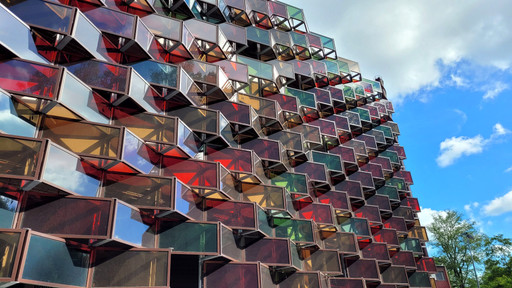

- Installed and commissioned Skåne’s largest solar cell façade on Sixt’s property in Staffanstorp. The photovoltaic façade has an installed capacity of 55.8 kWp and is expected to produce about 30,000 kWh annually

- Façade contract in the form of an approximately 1,750 sqm glass façade with glulam frame in Stockholm. The project will continue during 2025 and the first part of 2026 and with a total order value of approximately SEK 20 million

- The Annual General Meeting was held on 22 May and did not entail any changes to the composition of the Board of Directors

Significant events after the period

- Soltech has acquired and taken possession of 100 percent of the shares in Sesol from Nordic Capital. The purchase price will be paid with newly issued shares in Soltech, which means that Nordic Capital will be the largest owner with approximately 30 percent of the shares

- Planned rights issue of SEK 335 million fully guaranteed via a guarantee consortium where Nordic Capital has undertaken to subscribe for its share of approximately SEK 100 million and to further guarantee approximately SEK 50 million. This means a fully guaranteed issue, subject to approval by an extraordinary general meeting. The proceeds will be used to develop existing business areas, accelerate synergies and profitability-driving measures, refinancing of loans and debt, and for any future acquisitions

- An Extraordinary General Meeting has been held where the shareholders resolved on a directed consideration issue of shares, determination of the number of Board members and election of two new Board members, amendment of the Articles of Association and authorization for the Board of Directors to issue shares, warrants and/or convertibles

- Agreement with energy company Nordic Solar for a large-scale battery project. The project includes an 18 MWh battery park in Södertälje

The quarterly report and other financial reports are available at: https://soltechenergy.com/en/investors/financial-reports-calendar/

On July 4, 2025, Soltech Energy Sweden AB (publ) (“Soltech”, the “Company” or the “Group”) announced that the Company intends to carry out a new issue of shares with preferential rights for existing shareholders of approximately SEK 335 million, subject to approval by an extraordinary general meeting (the “Rights Issue”). Furthermore, it was announced that Nordic Capital has undertaken to subscribe for its pro rata share of the Rights Issue corresponding to approximately SEK 100 million and provided an underwriting guarantee of an additional SEK 50 million. Soltech can today announce that the Company, through Swedbank’s aid, has secured underwriting commitments that guarantee the remaining part of the issue amount in the planned Rights Issue. Soltech intends to make a formal decision on and publish the terms of the Rights Issue shortly.

Background

Soltech is a leading player in Sweden in solar energy, charging and energy storage in combination with roof, façade and electrical engineering companies. The Group has now become significantly better equipped for the future as a result of the completion of the deal announced on July 4, 2025, which was announced earlier today, meaning that Soltech has become the owner of 100 percent of the solar energy company Sesol while Nordic Capital has become the owner of 30 percent of the shares and votes in Soltech.

Soltech and Nordic Capital believe that the market in the EU for solar energy and charging and energy storage solutions is expansive. The assessment is based on the financial profitability for customers and the new EU rules that will gradually come into force from 2026 and which set requirements for solar energy installations on properties.

The acquisition of Sesol is a strategic step in the consolidation of the solar energy industry and strengthens Soltech’s market position in solar energy and energy storage, which has an obvious role in the energy system of the future as the cleanest and cheapest energy source. Soltech’s broad expertise and business base together with Nordic Capital’s industrial expertise create a strong platform to meet tomorrow’s need for smart total solutions for all types of properties.

Soltech has a unique position with its twenty operating subsidiaries in Sweden, Spain, the Netherlands and Norway, which are experts in complete solutions in solar energy (solar panels, batteries and charging solutions for B2B & B2C) as well as roof, façade and electrical technology. Soltech’s business breadth means that the Group is more stable than many competitors in a changing market.

Fully guaranteed Rights Issue of approximately SEK 335 million

In order to be able to exercise this position, a Rights Issue of approximately SEK 335 million is intended to be carried out, where the proceeds will be used to develop existing business areas, accelerate synergy effects and profitability-driving measures, refinancing of loans and debts and for any future acquisitions of new businesses with clear profitability.

Nordic Capital has undertaken to subscribe for its pro rata share of the Rights Issue corresponding to approximately SEK 100 million and has also provided an underwriting guarantee of an additional SEK 50 million. In addition, Soltech has, through Swedbank’s aid, secured underwriting commitments for the remaining part of the issue amount in the Rights Issue. The planned Rights Issue is thus fully guaranteed through subscription and guarantee commitments.

Soltech’s Board of Directors intends to shortly formally resolve on and publish the detailed terms and conditions of the Rights Issue and convene an Extraordinary General Meeting to approve the Rights Issue.

“Businesses in renewable energy sources, and not least solar energy, have had a challenging time on the world’s stock exchanges in recent years. We are convinced that Soltech will be able to navigate towards a more stable market and become a stronger and more profitable company. With the addition of Sesol to our Group, we will have even greater business volumes and synergies in sales, warehousing and logistics and purchasing. This, together with the fact that we have Nordic Capital as our largest owner, means that we have enough volume, expertise, contacts and capital to become a profitable company of the future.“, says Patrik Hahne, CEO of Soltech Energy.

Counsellor

Swedbank AB (publ) is acting as Sole Global Coordinator and Bookrunner and Snellman Advokatbyrå AB is acting as legal advisor in connection with the Rights Issue.

On 4 July 2025, Soltech Energy Sweden AB (publ) (”Soltech”) announced that an agreement had been entered into to acquire 100 percent of the shares in the solar energy company Sesol from Nordic Capital and that the purchase price will be paid with newly issued shares in Soltech. The transaction has now been completed and closed as of today. As a result of the transaction, Nordic Capital, through Artim Balance BidCo AB[1], has become owner of 30 percent of the shares and votes in Soltech.

For further information on the transaction, reference is made to the press release published by Soltech on 4 July 2025.

[1] Artim Balance BidCo AB is ultimately owned by Nordic Capital Fund XI. Nordic Capital Fund XI refers to Nordic Capital Fund XI Limited, which acts as general partner for Nordic Capital XI Alpha, LP and Nordic Capital XI Beta, LP, together with related investment companies.

On 4 July 2025, Soltech Energy Sweden AB (publ) (”Soltech”) announced that an agreement had been entered into to acquire 100 percent of the shares in the solar energy company Sesol from Nordic Capital and that the purchase price will be paid with newly issued shares in Soltech. All regulatory approvals required to close the transaction have now been obtained.

The transaction is expected to be completed and closed in the near future. Soltech will publish a press release as soon as the transaction has been closed.

For further information on the transaction, reference is made to the press release published by Soltech on 4 July 2025.

Soltech Energy Sweden AB (publ) (”Soltech” or the ”Company”) held an extraordinary general meeting today, 8 August 2025, in Stockholm whereby the following resolutions were passed by the meeting.

Directed issue of consideration shares

The meeting resolved, in accordance with the board of directors’ proposal, to increase the Company’s share capital through a directed share issue of not more than 56,691,168 shares. The shares are issued as payment to Artim Balance BidCo AB (a company controlled by Nordic Capital) in connection with Soltech’s acquisition of all shares in the solar energy company Sesol Group AB. The resolution was unanimous and was made in accordance with the majority requirement set out by the Swedish Securities Council as a condition for the validity of the exemption from the mandatory bid obligation granted to Artim Balance BidCo AB in relation to the subscription of the consideration shares.

Determination of number of members of the board of directors, election of two new members of the board of directors, and remuneration to newly elected members of the board of directors

The meeting resolved, in accordance with the board of directors’ proposal, for the period until the end of the next annual general meeting, that the board of directors shall be expanded from four to six members, that Jacob Langhard and Thomas Mejdell shall be elected as new members of the board of directors, and that a yearly remuneration of SEK 300,000, together with remuneration for any committee work in accordance with the decision of the most recent annual general meeting, shall be paid to each of the newly elected members of the board of directors, and that such remuneration to these members for the period from the time upon which their election takes effect until the end of the next annual general meeting shall be paid in proportion to the length of their respective terms. The resolutions are conditional upon and takes effect from the time of the Company’s completion of the acquisition of all shares in Sesol Group AB.

Amendment of the articles of association

The meeting resolved, in accordance with the board of directors’ proposal, to amend the number of shares in the Company’s articles of association from being not less than 80,000,000 and not more than 320,000,000 to being not less than 185,000,000 and not more than 740,000,000, and to amend the share capital in the articles of association from being not less than SEK 4,000,000 and not more than SEK 16,000,000 to being not less than SEK 9,250,000 and not more than SEK 37,000,000. The resolution is conditional upon that all new shares issued in the consideration share issue resolved on by the meeting are allocated and registered with the Swedish Companies Registration Office.

Authorisation for the board of directors to issue shares, warrants and/or convertibles

The meeting resolved, in accordance with the board of directors’ proposal, to authorise the board of directors to, for the period until the next annual general meeting, on one or more occasions resolve on issue of shares, warrants and/or convertibles, with or without deviation from the shareholders’ preferential rights, to be paid in cash, in kind and/or by way of set-off, whereby the number of shares that may be added though new subscription or conversion may not result in the number of shares exceeding the number permitted by the articles of association, and that the authorisation from the annual general meeting 2025 shall cease to be effective. The resolution is conditional upon that the new articles of association adopted by the meeting are registered with the Swedish Companies Registration Office.

For further information on the proposals that have now been approved by the extraordinary general meeting, please refer to the information in the notice to the extraordinary general meeting published on 9 July 2025.

Soltech Energy, through its subsidiary Soltech Energy Solutions, has entered into an agreement with the energy company Nordic Solar regarding a large-scale battery project. The project includes an 18 MWh battery park that has now begun construction in Södertälje. This is yet another project that Soltech is carrying out within its offering of large-scale battery parks. A solution that is growing in importance to enable the flexible and sustainable electricity system of the future.

In recent years, Soltech Energy Solutions has established itself as a leading player in both solar energy solutions and large-scale battery parks with associated smart control. An area that is becoming increasingly important for harmonizing the balance between electricity production and electricity consumption and for meeting increased and changing power needs.

Soltech Energy Solutions has now agreed and started the construction of another large-scale battery project that will be integrated with Svenska kraftnät’s ancillary services market and energy trading with Nord Pool’s spot market. The battery park that is being built will be Danish Nordic Solar’s first battery storage project in Sweden and their largest in the segment to date. The soil preparation has been completed and the facility has now entered the construction phase.

– The collaboration on a large-scale battery park for Nordic Solar demonstrates that our investment in a competitive large-scale battery offering is attracting interest from across the Nordic region. Battery parks play a key role in the energy transition and electrification as they contribute to increased grid stability and enable an increased expansion of renewable energy sources. We’re pleased to announce that construction is now underway, says Amadeus Bode, Commercial Manager Energy Storage at Soltech Energy Solutions.

Soltech is developing a growing portfolio of large-scale projects in both solar parks and battery storage, with the aim of supporting the energy transition in Sweden and in the Nordic region.

The shareholders of Soltech Energy Sweden AB (publ), reg. no. 556709-9436, (the “Company”) are hereby invited to the extraordinary general meeting on 8 August 2025 at 09.00 at the Company’s premises at Birger Jarlsgatan 41A in Stockholm. Entry and registration take place from 08.30.

Right to attend the general meeting

Shareholders who wish to attend the extraordinary general meeting shall:

- be registered as shareholder in the share register maintained by Euroclear Sweden AB on 31 July 2025 and if the shares are registered in the name of a nominee, ensure that the nominee registers the shares in the shareholder’s own name for voting purposes in such time that the registration is completed at the latest on 4 August 2025 (see further under the heading “Nominee-registered shares” below); and

- give notice of participation to the Company in accordance with the instructions set out under the heading “Notice of attendance” no later than on 4 August 2025.

Notice of attendance

Shareholders who wish to attend the general meeting in person or by proxy shall give notice to the Company thereof either by e-mail to info@soltechenergy.com or by post to Soltech Energy Sweden AB (publ), “Extraordinary general meeting”, Birger Jarlsgatan 41A, SE-111 45 Stockholm, Sweden. The notice of attendance shall state the shareholder’s name, personal identification number or corporate registration number, address, telephone number and, where applicable, the number of accompanying advisors (not more than two).

Shareholders who do not wish to participate at the general meeting in person, may exercise their voting rights at the general meeting through a proxy with a written, signed and dated power of attorney. If the power of attorney is issued by a legal entity, a copy of the certificate of registration or an equivalent authorisation document for the legal entity must be enclosed.

In order to facilitate the registration at the extraordinary general meeting, powers of attorney, certificates of registration and other documents of authority should be received by the Company at the address Soltech Energy Sweden AB (publ), “Extraordinary general meeting”, Birger Jarlsgatan 41A, SE-111 45 Stockholm, Sweden no later than on 4 August 2025. Please note that notice of attendance at the general meeting must be given even if the shareholder wishes to exercise its voting rights at the general meeting through a proxy. A submitted power of attorney is not considered as a notice of attendance at the general meeting. A template proxy form is available at the Company’s website (https://soltechenergy.com/en/) and will be sent to the shareholders who request it.

Nominee-registered shares

Shareholders whose shares are registered with a bank or other nominee must arrange through the nominee to have the shares temporarily registered in their own name in order to be entitled to participate in the extraordinary general meeting. Such registration (so-called voting rights registration), which normally is processed in a few days, must be completed no later than 4 August 2025 and should therefore be requested from the nominee well before this date. Voting rights registration requested by a shareholder in such time that the registration has been made by the relevant nominee no later than 4 August 2025 will be considered in preparations of the share register.

Proposed agenda

- Opening of the meeting and election of chairman of the meeting

- Preparation and approval of the voting list

- Approval of the agenda

- Election of one or two persons to approve the minutes of the meeting

- Determination of whether the meeting has been duly convened

- Resolution on a directed issue of consideration shares to Artim Balance BidCo AB

- Resolutions on determination of number of members of the board of directors, and election of two new members of the board of directors, and on remuneration to newly elected members of the board of directors

- Resolution on amendment of the articles of association

- Resolution on authorisation for the board of directors to issue shares, warrants and/or convertibles

- Closing of the meeting

Proposals for resolutions

Item 6: Resolution on a directed issue of consideration shares to Artim Balance BidCo AB

The board of directors of Soltech Energy Sweden AB (publ) (the “Company”) proposes that the general meeting resolves to increase the Company’s share capital through a share issue (the “Consideration Share Issue”) on the following terms:

- The Company’s share capital shall increase by not more than SEK 2,834,558.40 through an issue of not more than 56,691,168 shares.

- The right to subscribe for the new shares shall only rest with Artim Balance BidCo AB, reg. no. 559458-8914 (“Artim Balance”). The reasons for the deviation from the shareholders’ preferential rights is the agreement between the Company as purchaser and Artim Balance as seller regarding the Company’s acquisition (the “Acquisition”) of all shares in Kommstart 3974 AB (under name change to Sesol Group AB), reg. no. 559534-6866 (“Sesol Group”), under which Artim Balance shall have a right and obligation to subscribe for the new shares.

- A subscription price of SEK 2.065 shall be paid for each share, entailing a total subscription price of not more than SEK 117,067,261.92. The principle and basis for determining the subscription price in the Consideration Share Issue have been negotiated between the Company and Artim Balance, based on which the subscription price has been determined to SEK 2.065 per share, corresponding to 10 trading days’ volume-weighted average price paid for the Company’s shares on Nasdaq First North Growth Market during the period 19 June – 3 July 2025. The board of directors is therefore of the opinion that market terms in the Consideration Share Issue has been ensured.

- Subscription of the new shares shall be made on a separate subscription list no later than on 30 September 2025.

- Payment for the new shares shall be made no later than on 30 September 2025. The board of directors shall have the right to allow set-off according to Chapter 13, Section 41 of the Swedish Companies Act. It is noted that the intention of the board of directors is to allow such set-off of claims on the Company occurring in connection with Artim Balance’s sale of the shares in Sesol Group to the Company.

- The board of directors shall be entitled to extend the subscription period and the date for payment, respectively.

- The part of the subscription price exceeding the quota value of the shares shall be allocated the non-restricted share premium reserve.

- The new shares shall entitle to dividends the first time on the dividend record date that falls closest to the date on which the new shares are entered in the share register maintained by Euroclear Sweden AB.

- The CEO or the person designated by the CEO shall have the right to make those minor adjustments to the above resolution that may prove necessary for registration with the Swedish Companies Registration Office and Euroclear Sweden AB.

The resolution on the Consideration Share Issue shall be conditional upon Artim Balance receiving the necessary clearances from the Swedish Competition Authority and the Swedish Inspectorate of Strategic Products for completing the Acquisition.

The issue resolution shall be conditional upon that the general meeting’s resolution is supported (i) by shareholders representing at least two thirds of both the votes cast and the shares represented at the meeting and (ii) by shareholders representing at least two thirds of both the votes cast and the shares represented at the meeting with disregard to any shares held and represented at the meeting by Artim Balance.

Documents pursuant to Chapter 13, Section 6 of the Swedish Companies Act have been prepared.

Upon full subscription and allocation of the new shares in the Consideration Share Issue, Artim Balance will become the owner of 56,691,168 shares in the Company, corresponding to 30 per cent of all shares and votes in the Company after completion of the Consideration Share Issue.

Item 7: Resolutions on determination of number of members of the board of directors, and election of two new members of the board of directors, and on remuneration to newly elected members of the board of directors

Given the Company’s acquisition of the shares in Sesol Group and for the period until the end of the next annual general meeting, the board of directors of the Company proposes that the board of directors shall be expanded from four to six members, that Jacob Langhard and Thomas Mejdell shall be elected as new members of the board of directors, and that a yearly remuneration of SEK 300 000, together with remuneration for any committee work in accordance with the decision of the most recent annual general meeting, shall be paid to each of the newly elected members of the board of directors, and that such remuneration to these members for the period from the time upon which their election takes effect until the end of the next annual general meeting shall be paid in proportion to the length of their respective terms. The resolutions shall be conditional upon and take effect from the date of the Company’s completion of the acquisition of the shares in Sesol Group.

Thomas Mejdell, born in 1986 and a Norwegian citizen, is Managing Director at Nordic Capital Advisors and a member of the board of directors of Sesol, Sortera and RESMAN, and was previously a member of the board of directors of Macrobond and an analyst at Morgan Stanley. Thomas Mejdell holds a Master of Science in Finance from the Norwegian School of Economics. Thomas Mejdell does not own any shares in the Company.

Jacob Langhard, born in 1989 and a Swedish citizen, is Investment Director at Nordic Capital Advisors, member of the board of directors of Sesol and deputy member of the board of directors of Sortera and Cary Group, and was previously an analyst at Lazard. Jacob Langhard holds a Master of Science in Finance from the Stockholm School of Economics with studies at Yonsei University in Seoul. Jacob Langhard does not own any shares in the Company.

Item 8: Resolution on amendment of the articles of association

The board of directors proposes that the meeting resolves to amend the Company’s articles of association in accordance with the following:

It is proposed that the number of shares in the articles of association be changed from being not less than 80,000,000 and not more than 320,000,000 to being not less than 185,000,000 and not more than 740,000,000, and that the share capital in the articles of association be changed from being not less than SEK 4,000,000 and not more than SEK 16,000,000 to being not less than SEK 9,250,000 and not more than SEK 37,000,000.

§ 4 of the articles of association shall therefore read as follows in English:

“The share capital shall be no less than SEK 9,250,000 and not more than SEK 37,000,000.”

§ 5 of the articles of association shall therefore read as follows in English:

“The number of shares shall be not less than 185,000,000 and not more than 740,000,000.”

The resolution shall be conditional upon that the meeting resolves on the Consideration Share Issue pursuant to item 6 above and that all new shares in the Consideration Share Issue are allocated and registered with the Swedish Companies Registration Office.

For a valid resolution in accordance with the board of director’s proposal on amendment of the articles of association, the resolution must be supported by shareholders representing at least two-thirds of both the votes cast and the shares represented at the meeting.

Item 9: Resolution on authorisation for the board of directors to issue shares, warrants and/or convertibles

The board of directors proposes that the meeting resolves to authorise the board of directors to, for the period until the next annual general meeting, on one or more occasions resolve on issue of shares, warrants and/or convertibles, with or without deviation from the shareholders’ preferential rights, to be paid in cash, in kind and/or by way of set-off, whereby the number of shares that may be added though new subscription or conversion may not result in the number of shares exceeding the number permitted by the articles of association.

The main purpose of that the board of directors shall be able to resolve on an issue without preferential rights for shareholders as set out above is to be able to raise new capital to increase the Company’s flexibility and ability to accelerate the development of the Company’s operations or in connection with acquisitions, and to diversify the shareholder base. The issue of new shares, convertibles or warrants pursuant to the authorisation shall be carried out on customary terms and under prevailing market conditions. If the board of directors finds it appropriate, in order to enable the delivery of shares in connection with an issue in accordance with the above, this may be done at a subscription price corresponding to the quota value of the shares. The board of directors, or a person appointed by the board of directors, shall be entitled to make the adjustments that may be necessary in connection with registration of the resolution with the Swedish Companies Registration Office.

The resolution shall be conditional upon that the new articles of association pursuant to item 8 above are registered with the Swedish Companies Registration Office. Provided that the authorisation pursuant to the above becomes effective and is registered with the Swedish Companies Registration Office, the authorisation from the annual general meeting 2025 shall cease to be effective and is thereby replaced by the authorisation pursuant to the above.

For a valid resolution in accordance with the board of director’s proposal on authorisation, the resolution must be supported by shareholders representing at least two-thirds of both the votes cast and the shares represented at the meeting.

Other information on dispensation from launching a mandatory takeover bid and majority requirements

Artim Balance will, provided that the general meeting resolves on the Consideration Share Issue and that the Acquisition is completed, reach a shareholding in the Company representing at least three tenths (3/10) of the voting rights of all shares in the Company. According to Rule III.1 of the Stock Market Self-Regulation Committee’s Takeover Rules for Certain Trading Platforms, Artim Balance is in such case obligated to launch a takeover bid for all shares in the Company within four weeks thereafter. Artim Balance has applied for and obtained a dispensation from the Swedish Securities Council (Sw. Aktiemarknadsnämnden) from launching such mandatory takeover offer. The dispensation decision by the Swedish Securities Council is conditional upon that (i) the Company informs its shareholders on how large the share of capital and votes in the Company that Artim Balance may reach through the Consideration Share Issue, and (ii) the resolution of the general meeting in accordance with the board of directors’ proposal of the Consideration Share Issue is supported by at least two thirds (2/3) of the votes cast and shares represented at the general meeting, whereby any eventual shares and votes held and represented at the meeting by Artim Balance shall be disregarded. Upon full subscription and allotment of the new shares in the Consideration Share Issue, Artim Balance will become the owner of 56,691,168 shares in the Company, which corresponds to 30 per cent of all shares and votes in the Company after completion of the Consideration Share Issue.

Number of shares and votes

As of the date of this notice, the total number of shares and votes in the Company amounts to 132,279,393. The Company does not hold any own shares in treasury.

Shareholders’ right to request information

Shareholders are reminded of their right to request information from the board of directors and the CEO at the extraordinary general meeting in accordance with Chapter 7, Section 32 and Chapter 7, Section 57 of the Swedish Companies Act.

Documents available

Documents that shall be made available prior to the extraordinary general meeting pursuant to the Swedish Companies Act is made available at the Company and on the Company’s website (www.soltechenergy.com). The documents will also be sent to the shareholders who request it and state their postal address. Such a request may be sent to Soltech Energy Sweden AB (publ), Birger Jarlsgatan 41A, SE-111 45 Stockholm, Sweden or by e-mail to info@soltechenergy.com. The proposals in accordance with items 6-9 above are included in the notice in full.

Personal data

For information about how personal data is processed in relation to the meeting, please refer to the Privacy notice available on Euroclear’s website (https://www.euroclear.com/dam/ESw/Legal/Privacy-notice-bolagsstammor-engelska.pdf).

______________________________

Stockholm in July 2025

Soltech Energy Sweden AB (publ)

The board of directors