Advanced SolTech Sweden AB (publ) is considering issuing new green secured corporate bonds and publishing new financial information

In connection with this, ASAB has mandated DNB Markets and Nordea to investigate the conditions for ASAB to issue a new bond loan and to arrange meetings with selected bond investors starting on January 15, 2020. Subject to prevailing market conditions, a bond issue, Swedish benchmark size (or equivalent value in EUR), under a bond framework agreement of SEK 2,000 million with floating interest rates will be emitted. The Board of Directors of ASAB reserves the right to decide whether to cancel, suspend or postpone the bond issue in whole or in part. The funds from an issue is intended to be used to repurchase outstanding bonds and to finance ASAB's future growth.

ASAB's new collaboration with DNB Markets and Nordea, together with the previously announced intention to list ASAB's shares on Nasdaq First North Growth Market, is part of the new financing plan for the continued expansion in China where ASAB intends to target a wider circle of institutional investors.

Frederic Telander, CEO ASAB and Stefan Ölander, CEO SolTech Energy comment:

– We have previously communicated a goal to achieve an installed solar capacity equivalent to 1 GW (1000 MW) in 2023, which is fully connected to the electricity grid in 2024. The demand for our offer in China remains very good and we have a strong pipeline of high-quality projects waiting for funding. The investments are made where they have the greatest positive climate impact and with this transaction, we lay the foundation we need for our journey towards the creation of a green energy company in the frontline.

New financial information

In connection with ASAB evaluating the possibility of issuing bonds, new financial information that has not been public previously, is published.

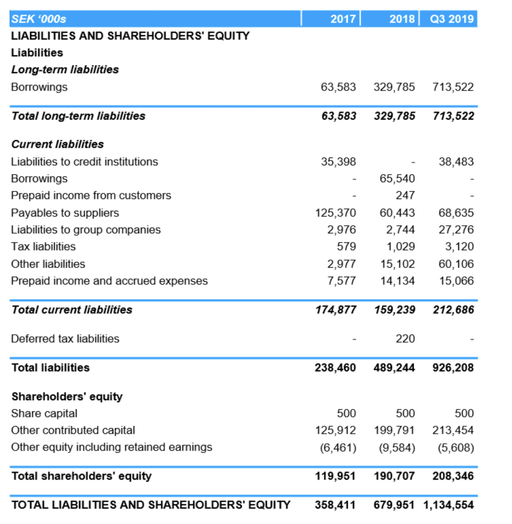

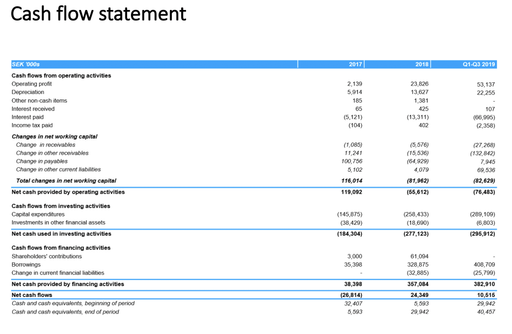

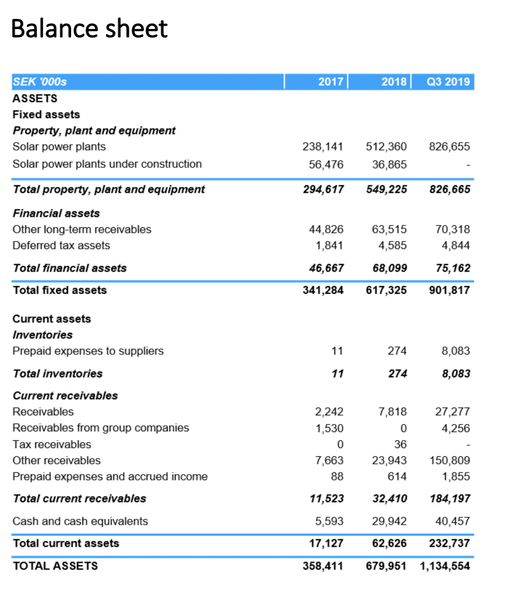

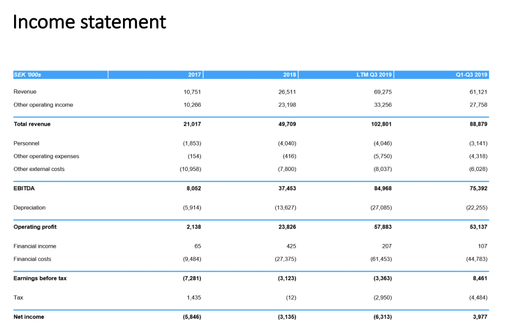

ASAB is in a strong expansion phase and had, as of December 31, 2019, an installed capacity of 139.2 MW in its portfolio of solar power plants with an annual revenue capacity of approximately SEK 161 million and EBITDA of approximately SEK 141 million, given certain assumptions. The company has furthermore prepared combined financial statements for the Group in which ASAB is the parent company for the full year 2017 and 2018 and for the period 1 January 2019 – 30 September 2019

The new financial information is described in more detail in a presentation on the company's website: [LINK].

For more information contact: Frederic Telander, CEO, Advanced Soltech Sweden AB (publ). Tel: 070-525 16 03. E-mail: frederic.telander@soltechenergy.com or Stefan Ölander, CEO SolTech Energy Sweden AB (publ) Tel: 070-739 80 00. E-mail: stefan.olander@soltechenergy.com

The information in this press release is such that Soltech Energy Sweden AB (publ) is to publish in accordance with EU Regulation No 596/2014 on market abuse. The information was provided through the above contact person's publication for publication on January 13, 2020 at. 07:30 CET

Advanced SolTech Sweden AB (publ) – ASAB In order to continuously finance investments in China, the SolTech Group’s parent company and its partner in China, Advanced Solar Power Hangzhou Inc., have formed ASAB. ASAB’s business consists of lending to Group companies to finance solar power plants in China that are owned and managed by ASRE, LSE or its wholly owned local subsidiaries.

The company’s Certified Adviser is FNCA, telephone 08-528 00 399 E-mail: info@fnca.se More info at www.advancedsoltech.com

About Soltech Energy Sweden AB (publ) Soltech Energy is a comprehensive supplier that develops, sells, installs and optimizes solar energy solutions for our customers' needs. The group includes the subsidiaries Advanced Soltech Sweden AB (publ) where the Chinese investment is conducted, Soltech Sales & Support, NP-Gruppen, Swede Energy Power Solutions, Merasol and Soldags. Soltech Energy Sweden AB (publ), is traded on Nasdaq First North Growth Market under the short name SOLT and has approximately 31,000 shareholders. The company's Certified Adviser is Erik Penser Bank. Phone: 08-463 83 00. Email: certifiedadviser@penser.se. For more information see: www.soltechenergy.com

About the China venture Soltech Energy’s investment in China is conducted in Advanced Soltech Renewable Energy (Hangzhou) Co. Ltd., ASRE and Longrui Suqian (LSE). The business model consists of ASRE and LSE financing, installing, owning and managing solar energy installations on customers’ roofs in China. The customer does not pay for the solar facility, but instead commits to purchase the electricity that the plant produces during a 20-year agreement. ASRE’s current revenue comes from the sale of electricity to customers and from various forms of subsidies per produced kilowatt hour (kWh) of solar electricity. The goal is to have an installed capacity of 1000 megawatts (MW) fully connected to the electricity grid in 2024