Soltech Energy Sweden AB (publ) has today published its annual report for 2021.

Another unusual year has come to an end, and we are proud to have been able to deliver such a strong 2021 as we have done, given the effects of the Corona pandemic.

We land on total revenues of SEK 951.8 million (499) from operations and deliver 91% growth at Group level, excluding revaluation effects from the special listing of Advanced Soltech of SEK 288 million. The Group's operating profit (EBIT) amounted to SEK 150.7 (42.8) million, an increase of 252%.

We are very humble going forward in 2022, due to the Corona pandemic still raging in large parts of the world and not least due to global developments after February 24 with the war in Ukraine. But both the Corona pandemic and the war will come to an end and then we look forward to an even stronger market growth.

For a complete report of the 2021 accounts, please refer to the attached annual report, including the auditor's report.

The annual report in its entirety, together with the auditor's report, can also be read and downloaded from Soltech Energy Sweden AB's website: htps://soltechenergy.com/investerare/finansiella-rapporter-kalender/

For a printed copy please order at: Info@soltechenergy.com

The Soltech company Soltech Energy Solutions has been commissioned to build a 38,000 sq m solar energy solution for Coop Sverige AB consisting of CFP * -certified panels with recycled silicon from Norway and silicon from Germany and the USA. The facility will be installed at Coop's new, fully automated, goods terminal and will cover half of the entire property's electricity needs. The project is planned for the turn of the year 2022/2023.

The solar energy company Soltech Energy Solutions develops large-scale solar energy projects as well as charging and storage solutions for landowners, property owners and logistic developers. The solar energy company will now construct a solution for Coop Sverige in Eskilstuna. Their new fully automated goods terminal will have a 38,000 square meter roof-mounted installation.

The solar panels to be installed are CFP-certified with a mixture of recycled silicon. Silicon is one of the most important components in a solar panel and the production of silicon is energy intensive. Therefore, the climate footprint of this solar energy installation is lower, and durability is a key factor for the whole life cycle of the installation.

– The solar energy solutions at Coop's product terminal in Eskilstuna will be green in a double sense as the solar panels are CFP-certified. This is a great investment by Sweden's most sustainable brand** Coop and we are proud to have been entrusted to construct and build this installation, says Jesper Ståhlberg, Key Account Manager, Soltech Energy Solutions.

Coop's terminal will be powered entirely by renewable electricity

The solar cell solution is estimated to cover approximately 50 percent of the property's annual electricity use and the remaining electricity is purchased from other renewable energy sources. A product terminal of this size has a high electricity consumption, which makes a solar energy extra welcome. Both to secure the supply of renewable electricity but also to reduce Coop's climate footprint.

– Acting sustainably permeates all operations within Coop. Now we are investing in the future with a new fully automated terminal in Eskilstuna and then we will of course make it as smart and sustainable as possible. For us, it became obvious to invest in a large-scale solar energy installation on the roof of the terminal. We look forward to working with our partner Soltech in the installation of Sweden's largest roof-mounted solar energy solutions, says Örjan Grandin, CEO of Coop Logistik.

*CFP-certified panels are products with a better climate footprint value in their life cycle analysis. CFP stands for Carbon footprint.

** according to Sustainable Brand Index 2021

The shareholders in Soltech Energy Sweden AB (publ), corporate identity no. 556709-9436, (the “Company”) is called to the Annual General Meeting on Thursday, May 12, 2022 at 17:00 at Elite Hotel Stockholm Plaza, Birger Jarlsgatan 29. Registration begins at 16:30.

The Board has decided that the shareholders shall be able to exercise their voting rights at the Annual General Meeting also by postal vote in accordance with Sections 22 of the Act (2022: 121) on temporary exemptions to facilitate the conduct of general and general meetings.

Exercise of voting rights at meetings, the right to participate and registration

Shareholders who wish to exercise their voting right on site in the meeting room in person or via a representative must:

On the one hand, be entered in the share register kept by Euroclear Sweden AB no later than Wednesday

4 May 2022 (for nominee-registered shares, see also “Nominee-registered shares” below), and

On the one hand, they have announced their participation in the meeting no later than Monday, May 9, 2022, at the address Soltech Energy Sweden AB (publ). Annual General Meeting, Tegnérgatan 1, 111 40 Stockholm or via e-mail to stamma@soltechenergy.com. In the notification, shareholders must state their name and social security number or company and organization number. In addition, the address, telephone number, shareholding and any assistants (maximum one) must be stated.

Shareholders may appoint a proxy. Shareholders who are represented by a proxy must issue a written and updated power of attorney for the proxy. The power of attorney is valid for a maximum of one year from the date of issue, unless the power of attorney specifically states a longer period of validity, however, for a maximum of five years from the time of issue. Authorization documents issued by a legal entity must be accompanied by authorization documents (registration certificate or equivalent). The original power of attorney and any authorization documents should be submitted to Soltech Energy Sweden AB in good time before the Annual General Meeting, however no later than 9 May 2022. Annual General Meeting, Tegnérgatan 1, 111 40 Stockholm. Proxy forms are available on the company's website, https://soltechenergy.com/investerare/bolagsstyrning/

Aktieägare som önskar utöva sin rösträtt genom poströstning skall

On the one hand, be entered in the share register kept by Euroclear Sweden AB no later than Wednesday

4 May 2022 (for nominee-registered shares, see also “Nominee-registered shares” below), and

Partially no later than Monday, May 9, 2022, register by casting your postal vote according to the instructions below so that the postal vote is received by the company no later than that day

Instructions for postal voting

To vote at the meeting, shareholders must use the postal voting form and follow the instructions available on the company's website, https://soltechenergy.com/investerare/bolagsstyrning/. The postal voting form applies as a notification to the meeting. The postal voting form must be sent:

• by post to Soltech Energy Sweden AB (publ). Tegnérgatan 1, 111 40 Stockholm (mark the envelope with "Soltech Energy Annual General Meeting")

The shareholder may not provide the postal vote with special instructions or conditions.

If this happens, the vote (i.e. the individual postal vote in its entirety) is invalid.

Further instructions and conditions can be found in the postal voting form.

Nominee-registered shares

To be entitled to participate in the Annual General Meeting, a shareholder whose shares are nominee-registered through a bank or other nominee must, in addition to registering at the Annual General Meeting, have the shares registered in their own name so that the shareholder is entered in the share register on 4 May 2022. Such registration may be temporary (so-called voting rights registration) and is requested from the nominee according to the nominee's routines at such time in advance as the nominee determines and in good time before Wednesday, May 4, 2022, when such registration must be completed.

Proposed agenda

1. Opening of the meeting

2. Election of chairman at the meeting

3. Establishment and approval of the ballot paper

4. Approval of the agenda

5. Selection of one or two protocol adjusters

6. Examination of whether the meeting has been duly convened

7. Speech by the CEO

8. Presentation of the annual report and auditor's report as well as the consolidated accounts and consolidated auditor's report for the financial year 2021.

9. Decision:

i. Adoption of the income statement and balance sheet as well as the consolidated income statement and consolidated balance sheet.

ii. Appropriations regarding the Company's earnings in accordance with the approved balance sheet.

iii. Discharge of liability for the board members and the CEO.

10. Determination of the number of board members

11. Decision on remuneration to the Board

12. Determination of auditors' fees

13. Election of board

14. Election of Chairman of the Board

15. Election of auditor

16. Resolution on nomination committee principles

17. Resolution on amendment of the Articles of Association

18. Resolution authorizing the Board of Directors to issue shares, convertibles and warrants

19. Any other decisions

20. Closing of the meeting

Proposition for resolution

Item 2 – Election of chairman of the meeting

The Board of Directors proposes that Göran Starkebo be elected Chairman of the Meeting.

Item 9 (ii) – Outline of the Company's earnings

The Board of Directors proposes that no dividend be paid to the shareholders, and that amounts available to the Annual General Meeting be transferred to a new account.

Item 10 – Determination of the number of board members

The Nomination Committee proposes that the number of board members to be elected by the AGM be six without deputies.

Items 11–12 – Determination of board fees and auditors' fees

The Nomination Committee proposes that a board fee of SEK 500,000 be paid to the Chairman of the Board and that a board fee of SEK 250,000 be paid to each of the other members of the Board. If the board establishes a committee, the fee to a member shall be SEK 40,000 per person and committee. The chairman of the committee shall receive a fee of SEK 60,000. However, a board member who is reimbursed by the Company due to employment shall not receive a fee, either in the parent company or in subsidiaries.

It is proposed to the auditor that fees be paid according to an approved invoice.

Item 13-14 – Election of board and chairman of the board

The Nomination Committee proposes the following persons to Board members and Chairman of the Board for the period until the next Annual General Meeting:

Board members

a) Mats Holmfeldt (re-election)

b) Vivianne Holm (new election)

c) Hellen Wohlin Lidgard (re-election)

d) Göran Starkebo (re-election)

e) Johan Thiel (new election)

f) Stefan Ölander (re-election)

Chairman of the Board

g) Mats Holmfeldt

Anna Kinberg Batra and Jimmie Wiklund have declined re-election for the coming period.

The Nomination Committee's proposal for new members Vivianne Holm and Johan Thiel is considered to possess the competence required to contribute to the company's expansion in a good and constructive manner. The Nomination Committee proposes Mats Holmfeldt as Chairman, who is currently a member of the Board as a member, and is considered by the Nomination Committee to have the right competence for the assignment as Chairman of the company.

Information on all proposed board members is available at www.soltechenergy.com/investor/corporate governance/

Item 15 – Election of auditor

The Nomination Committee proposes that the Annual General Meeting, for the period until the end of the next Annual General Meeting, re-elect PricewaterhouseCoopers i Sverige AB (PWC) as the Company's auditor. PWC has announced that in the event that PWC is elected, PWC will appoint Claes Sjödin as the principal auditor.

Item 16 – Decide nomination committee principles

The Nomination Committee is appointed by the Chairman of the Board contacting at least three of the largest shareholders in the Company in terms of votes as of September 30, 2022, who (if they so wish) may each appoint a representative to constitute the Company's Nomination Committee. If any of the three largest shareholders waives their right to appoint a member to the Nomination Committee, such right shall pass to the next shareholder in the order of magnitude, who has not already been offered the opportunity to appoint a member of the Nomination Committee.

It is up to the nomination committee to appoint its chairman.

The Nomination Committee shall otherwise follow the principles in the Swedish Code of Corporate Governance.

Item 17 – Resolution on amendment of the Articles of Association

The Board of Directors proposes that the Annual General Meeting resolves to amend the Articles of Association. This is in order to provide opportunities for the Board to act quickly when there is a need to issue new shares either for company acquisitions or issue procedures. The Board proposes the following:

• The limits for the company's share capital (§ 4 of the Articles of Association) change from the lowest SEK 2,000,000 and a maximum of SEK 6,000,000 to a minimum of SEK 3,000,000 and a maximum SEK 7,500,000.

• The limits for the company's number of shares (§ 5 of the Articles of Association) are changed from a minimum of 40,000,000 and a maximum of 120,000,000 to a minimum of 60,000,000 and a maximum of 150,000,000.

Item 18 – Resolution authorizing the Board of Directors to decide on a new issue of shares and the issue of warrants and convertibles.

The Board proposes that the Annual General Meeting resolves to authorize the Board to, until one or more occasions, decide on a new issue of shares and / or issue of convertibles and / or warrants until the next Annual General Meeting, even with deviation from the shareholders' preferential rights. The shares, convertibles and / or warrants must be able to be subscribed for against cash payment or against payment by set-off, by contributing in kind, or otherwise with conditions. The authorization is limited to the number of shares in the case of a new issue or in the issue of warrants and convertibles, the number of warrants and convertible debentures that may involve issuance or conversion to the corresponding number of shares, calculated at the time of issue of such warrants or convertibles. on number of shares.

Item 20 – Closing of the Meeting

Provision of documents

Annual report documents and the auditor's report as well as the Board's complete proposal as above will be kept available at the Company's offices for at least three weeks before the meeting and sent free of charge to shareholders who have notified that they wish to receive such information from the Company. All documents will also be available at the same time on the Company's website, https://soltechenergy.com/investerare/bolagsstyrning/.

Information on the number of shares and votes and on the holding of own shares

The total number of shares and votes in the company at the time of this notice was 97,140,849. All issued shares have equal voting rights. The company does not hold any own shares.

Majority requirements

Resolutions pursuant to items 16 and 17 above are valid only if they have been supported by shareholders with two thirds of both the votes cast and the shares represented at the meeting.

Shareholders' right to request information

The Board of Directors and the CEO shall, if any of the shareholders so request and the Board considers that this can be done without significant damage to the company, provide the Annual General Meeting with information on circumstances that may affect the assessment of a matter on the agenda and circumstances that may affect the assessment of the company's financial situation. The disclosure obligation also refers to the company's relationship with another group company and the consolidated accounts, as well as such matters regarding subsidiaries as are referred to in the first paragraph.

______________________________

Stockholm April 2022

Soltech Energy Sweden AB (publ)

The Board of directors

One of Soltech's subsidiaries in the electrical engineering industry, Neabgruppen, won a new project for electrical installations in what will be a new Clarion hotel in Södertälje. The assignment will be carried out for the construction company ED Bygg i Sverige AB. Construction will start in 2022 and solar cells are available as an option in the assignment.

Following a qualitative procedure, Neabgruppen with operations in southern Sweden, Stockholm, Linköping and Norrköping, has entered into an agreement with one of the leading construction companies, ED Bygg. The assignment applies to electrical installations in what will be Clarion Hotel's new hotel in Södertälje, with a possible solar energy solution as an option to further contribute to the green transition. The hotel will consist of 200 rooms and will also have a gym and sky bar.

Electrical installations will start in 2022 and the project is expected to be completed in 2024 by Neabgruppen, which is a total subcontractor for the electrical installation and future solar cells. Pelle Norberg, CEO of Neabgruppen, comments on the assignment and the even closer collaboration with ED Bygg.

– It feels great that we get the confidence to carry out this assignment. We already have a very good collaboration with ED Bygg, which is now further deepened and the discussion about solar energy also aligns with both companies' focus on sustainability. Neabgruppen is ready to start up the work and this really strengthens our presence in Mälardalen, says Pelle Norberg, CEO of Neabgruppen.

On April 1, Soltech Energy Sweden AB (publ) acquired 53.3 percent of the shares in the Dutch solar energy company 365 Energie Holding B.V. (365zon) based in Eindhoven, the Netherlands. The company had sales of SEK 250 million in 2021 and is estimated to have sales of approximately SEK 350 million in 2022 with an operating profit of approximately 10 percent. This is Soltech's first international acquisition and establishes the Group in the growing Dutch solar energy market. The acquisition is financed entirely with own cash and with newly issued Soltech shares.

The acquisition of 365zon in financial terms:

• The acquisition payment for 53.3% of the shares amounts to SEK 115.7 million *

• The acquisition is paid for with an initial cash portion of SEK 57.85 million and with newly issued Soltech shares to a value of SEK 57.85 million

• After 12, 24 and 36 months, a further total of approximately SEK 25.7 million / year * can be paid in variable additional purchase consideration if set sales and profitability targets are achieved. Which would give a total acquisition payment of SEK 192.8 million *

• Soltech has an option to buy up the remaining 46.7% after 2024 at a market valuation

• The acquisition of 365zon is financed entirely with own cash and with newly issued Soltech shares

• Soltech and 365zon's assessment is that the acquisition will contribute approximately SEK 260 million in sales during the financial year 2022 (nine months) with a positive operating profit of approximately 10%

• During the years 22-23-24, 365zon is expected to contribute with more than SEK 1,200 million in sales with an operating profit of 10%

• Synergy effects, primarily in purchasing and logistics through this acquisition, are expected to have a positive effect on sales and earnings throughout the Group

Soltech now embarks on its international expansion by acquiring a leading solar energy company in the Netherlands. 365zon was founded in 2012 and has had a successful growth journey with sales of approximately SEK 250 million in 2021. The company focuses on solar energy solutions and charging solutions for the consumer market, housing associations and members- and consumer organizations for homeowners and tenant-owners. 365zon has just over 40 employees.

365zon is one of the largest solar energy companies in the growing Dutch market where an investment in solar energy has become more and more profitable, the residents have an increased environmental awareness and several political reforms have created a rapidly growing demand for solar cells and charging solutions.

Since the start in 2012, the company has completed over 20,000 successful installations and with its nationwide installation capacity, the company now has an average of approximately 6,500 solar cell installations annually in the Dutch consumer market.

– Our international expansion now begins, which is a fantastic milestone. 365zon is a market-leading solar energy company in the Netherlands with good profitability and which is perfectly positioned to meet the increased demand for solar energy as well as charging and storage solutions in the private housing market. We are very happy to have them on board and today the journey begins towards establishing Soltech's acquisition strategy in new geographical markets, without slowing down the acquisition rate in Sweden, says Stefan Ölander, CEO of Soltech Energy.

The acquisition strategy is taken abroad

The acquisition of 365zon is Soltech's first in the Netherlands. The goal internationally is the same as in Sweden. To start with the acquisition of solar energy companies and then also acquire companies in the roofing, sheet metal, facade and electrical engineering industries with the goal of adding solar energy to their product range and transforming the companies.

A transformation strategy that benefits the customers through high quality and also creating positive synergy effects in areas such as purchasing and logistics, both for the subsidiaries in Sweden and the Netherlands.

– Soltech is a strong European solar energy company, and I am thrilled about entering the next growth phase for 365zon together with them. The main benefits of the new collaboration for 365zon are the increased buying power, having a financially strong partner to help further accelerate the growth of the company and the ability to soundboard with other solar energy companies in the rest of Europe. Working with Oscar, Stefan and the rest of Soltech's M&A team was a great pleasure, says Lars Buuts, founder and CEO of 365zon.

M&A firm Oaklins assisted 365zon with M&A advice in the transaction.

* Exact MSEK depends on the euro exchange rate

On March 31, Soltech Energy Sweden AB (publ) acquired 40 percent of the shares in the subsidiary Din Takläggare i Värmland-Dalsland AB (Din Takläggare). Soltech now owns 100 percent of the company. At the same time, the Group makes its first bolt-on acquisition by acquiring 100 percent of the solar energy company Solexperterna Värmland AB (Solexperterna). The acquired company will be part of the now wholly owned subsidiary Din Takläggare from 1 April. This further strengthens Din Takläggare's solar energy competence and installation capacity. Solexperterna are expected to contribute with approximately SEK 5 million in sales during 2022. The acquisitions are financed entirely from its own assets and with newly issued Soltech shares.

Soltech acquired 60 percent of Din Takläggare on September 29, 2020 and is now acquiring the remaining 40 percent. The company is active in roofing and solar energy mainly in Värmland and Dalsland. Since joining the Group, Din Takläggare has been involved in three solar energy installations in its ambition to become, in line with Soltech's transformation strategy, a roofing company that also offers solar energy services.

They are now given even better opportunities when the Group completes its first additional acquisition, also known as a bolt-on acquisition. It is the solar energy company Solexperterna that is acquired and merged into the subsidiary.

– It feels very good that we are acquiring the remaining part of Din Takläggare and at the same time making a bolt-on acquisition that strengthens their business area solar energy. We work actively to develop our subsidiaries, both organically and through strategic bolt-on acquisitions such as this. Our subsidiaries will always be given the best possible conditions to grow and take new market shares, says Stefan Ölander, CEO of Soltech Energy.

A bolt-on acquisition that creates competitive advantages

Solexperterna are active in Värmland and the surrounding area and provide their customers business with a wide range of services in solar energy solutions with a holistic and sustainable perspective. The company currently has about 5 employees and has previously worked closely with Din Takläggare, of which it is now a part.

– We take an exciting new step on our growth journey. Solexperterna is a very competent solar energy company that we earlier have had a great collaboration with. The fact that we are now acquiring their solar energy competence will create even greater value for us in the future and we are very pleased that Soltech is helping us with this bolt-on acquisition, says Håkan Wennberg, CEO of Din Takläggare.

On March 21, Soltech Energy Sweden AB (publ) acquired 30 percent of the shares in the subsidiary Fasadsystem i Stenkullen AB (Fasadsystem) with access on March 21, 2022. Soltech Energy now owns 100 percent of the company and the acquisition of the remaining shares in the company is a part of the ongoing work to strengthen Soltech's offering in solar facades. Fasadsystem has 38 employees and sales of almost SEK 95 million in 2021 with a profit of just over SEK 10 million (EBIT). The acquisition is financed entirely from its own assets and with newly issued Soltech shares.

Soltech acquired 70 percent of Fasadsystem on April 23 2020 and is now acquiring the remaining 30 percent. An agreement was signed on March 21, with the meaning that Soltech increases their investment the façade segment as well as in solar cell facades. Fasadsystem gets an even larger opportunity to broaden their offering in large-scale solar cell facades, in addition to their core business.

– Fasadsystem is a successful family business and a much-appreciated company within the Soltech Group. They are involved in several of our most notable solar energy projects, and we clearly see that solar cell facades are an appreciated segment among our customers. It is therefore with pleasure that we acquire the remaining part of the company, says Stefan Ölander, CEO of Soltech Energy.

Builds Sweden's largest solar cell facade

Fasadsystem is one of Western Sweden's leading companies in the facade industry with over 40 years of experience in various solutions and cutting-edge expertise for the development of modern, functional, and stylish facades.

Since Fasadsystem became part of the Soltech Group, they have also been able to offer large-scale sustainable, aesthetic and technically smart building-integrated solar energy solutions for facades. The company is, among other things, involved in what will be Sweden's largest solar cell façade in Jönköping and Wallenstam's colorful solar cell façade in Mölnlycke Fabriker.

– Now we will get an even better opportunity to develop our high-quality facade products and continue to offer large-scale solar energy solutions to new and existing customers. We thrive in the Soltech Group, and this is a natural step that give us and our staff better new ways to meet at future where solar cell facades are becoming increasingly important for the construction and real estate industry, says Tommie Standerth, CEO of Fasadsystem.

NP Gruppen, a subsidiary in the Soltech Group, has won a solar energy procurement in Malmö. The roofing company will install solar energy installations on 13 properties. The installations are being carried out for MKB Fastighets AB and is expected to be completed during 2022.

Stockholm based NP Gruppen was acquired in 2019 and was Soltech's first roofing company with a history that stretches all the way back to the 60s. Since joining the Soltech Group, they have transformed into a roofing specialist that also offers solar energy solutions. NP Gruppen has completed several solar energy projects in the past year and has its own solar energy business area.

The procurement applies to 13 properties in Malmö that will have roof-placed solar energy systems installed. The properties are owned by MKB Fastighets AB, one of Sweden's largest public housing companies.

The properties that will get the solar energy solutions are apartment buildings and one of the houses is a student residence. It will be NP Gruppens third project in southern Sweden and Marcus Juhlin, solar energy manager at NP Gruppen, is happy about the upcoming solar energy project.

– We are very proud of the confidence and to collaborate with a customer who makes a great sustainability investment. We are more than ready to start the work so that more people in Malmö get their homes powered with the help of solar energy, says Marcus Juhlin, Solar energy manager at NP Gruppen.

Fourth quarter in brief

▪ The Group's revenues in the fourth quarter amounted to SEK 565.8 (163.3) million. An increase of 247%. Of the revenues, SEK 288 million is dependent on the special listing of Advanced Soltech Sweden AB (“ASAB”) as a revaluation result. This did not affect the cash flow. Excluding this effect, total revenue from operations amounted to 277.8.

▪ Revenues in the Swedish operations increased to MSEK 266.6 (56.4), an increase of 373%.

▪ Revenues in the Chinese operations amounted to MSEK 11.2. The operations of Advanced Soltech Sweden AB (“ASAB”) are only consolidated until October 29, 2021, for the remainder of the quarter ASAB is reported according to the equity method. The result for the period October 30 – December 31 amounted to MSEK 1.8 and is reported under the heading, profit from participations in associated companies.

▪ The Group's profit before depreciation (EBITDA) amounted to MSEK 267.3 (14.6). The increase was a result of the special listing of ASAB.

▪ The Group's operating profit (EBIT) developed positively to MSEK 166.3 (-1.2). EBIT has been affected by the special listing of Advanced Soltech, where a non-cash flow-affecting revaluation result of MSEK 288 arose. EBIT is also affected by increased amortization and write-downs of goodwill as a direct result of completed acquisitions and completed restructuring and revaluations of goodwill.

▪ Profit for the period after tax amounted to MSEK 138.2 (-80.4). The result in the fourth quarter was negatively affected by unrealized, non-cash flow-affecting exchange rate differences in the Chinese operations by MSEK -7.7 (-29.2).

▪ Cash flow for the period from operating activities amounted to -31 (-30.5).

▪ The period's cash flow for the Group amounted to MSEK -157.2 (27.2). The cash flow for the period was affected by, among other things, acquisitions of subsidiaries, investments in fixed assets and the special listing of Advanced Soltech.

▪ Earnings per share amounted to SEK 1.55 (-0.71).

▪ No dividend is proposed.

January – December in brief

▪ The Group's revenues for the year amounted to MSEK 1,239.8 (499.4). An increase of 148%. Of the revenues, SEK 288 million is due to the special listing of Advanced Soltech Sweden AB (“ASAB”) as a revaluation result that did not affect cash flow arose on the sale. Excluding this effect, total revenue from operations amounted to 951.8. The Group's organic growth amounted to 29%.

▪ Revenues in the Swedish operations increased to SEK 820.9 (353) million, an increase of 133% compared with the previous year.

▪ Revenues from Advanced Soltech Sweden AB (“ASAB”) amounted to MSEK 130.9 (146.1) and have been consolidated up to and including the special listing on October 29, 2021. After the special listing, for the period October 30 – December 31, ASAB is reported according to the equity method.

▪ The Group's profit before depreciation (EBITDA) amounted to MSEK 317.6 (101.9). An increase of 212%. The increase was a result of the special listing of ASAB.

▪ The Group's operating profit (EBIT) amounted to MSEK 150.7 (42.8). An increase of 252%. EBIT has been affected by the special listing of Advanced Soltech, where a non-cash flow-affecting revaluation result of MSEK 288 has arisen. EBIT is also affected by increased amortization and write-downs of goodwill as a direct result of completed acquisitions and through restructuring and revaluations of goodwill.

▪ Profit for the year after financial posts, currency effects and tax amounted to MSEK 77.6 (-141) . Currency effects of unrealized exchange rate differences in the Chinese operations have affected earnings by MSEK 51 (-42.8).

▪ The year's cash flow from operating activities amounted to -103.7 (-8.7).

▪ The year's cash flow for the Group amounted to MSEK 115.2 (120.6). This year's cash flow has been affected by new issues, acquisitions of subsidiaries, investments in fixed assets and the special listing of Advanced Soltech.

▪ During the year, Covid-19 has affected the Swedish operations through increased transport costs and price increases for, among other things, solar panels. Increased sick leave has led to some delays in the completion of projects.

Significant events during the fourth quarter

▪ Soltech Energy Sweden AB's subsidiary Advanced Soltech Sweden AB (ASAB) was listed on the Nasdaq First North Growth Market on 29 October. In connection with the special listing, a revaluation result arose in the Group. The revaluation result amounted to MSEK 288 based on consolidated values at the time of divestment of the shares in ASAB.

The revaluation result does not affect cash flow and is reported under other income and is specified in Note 1. After the special listing, Soltech's holding amounts to 29.35%, which means that Soltech Energy Sweden AB (publ) no longer has the controlling influence. ASAB is therefore not reported as a subsidiary but as an associated company according to the equity method.

▪ Soltech Energy Sweden AB's subsidiaries Swede Energy and Merasol were merged during the fourth quarter and Soltech Sales & Support was partially integrated, the new company is called Soltech Energy Solutions 1988 AB.

▪ Soltech Energy Sweden AB (publ) acquired 100 percent of the shares in the Neabgruppen with access on October 1, 2021.

▪ Soltech Energy Sweden AB (publ) acquired 100 percent of the shares in ESSA Glas & Aluminium AB (ESSA) with access on December 30, 2021.

▪ Soltech Energy Sweden AB (publ) acquired 70 percent of the shares in Falu Plåtslageri AB (Falu Plåtslageri) and Tak & Bygg in Falun AB (Takab) with access on January 5, 2022.

▪ Soltech Energy Sweden AB (publ) acquired the remaining 40 percent of the shares in the subsidiary Miljö & Energi Ansvar Sverige AB (Measol) with access on December 31, 2021.

▪ The Nomination Committee prior to the Annual General Meeting on 12 May 2022 in Soltech Energy Sweden AB (publ) has been appointed.

Significant events after the reporting period

▪ Soltech's subsidiary ESSA Glas & Aluminium AB has won a tender for the execution of a façade contract with construction starting in the summer of 2022. The assignment is performed for the Stockholm Region, through Locum AB, and has an order value of MSEK 92.

▪ Soltech Energy's subsidiary Soltech Energy Solutions and Falkenklev Logistik are deepening their collaboration. In addition to the 1.5-hectare solar park Soltech will build, both companies, together with Scania, will also build Sweden's largest charging and battery park for trucks. The project is part-financed by the Swedish Environmental Protection Agency. Soltech's order value for the battery park amounts to MSEK 20.

▪ Soltech Energy's subsidiary, Soltech Energy Solutions, will build Sweden's largest solar park connected to only one industry for Åbro Bryggeri in Vimmerby. The solar park will cover an area of 10 hectares and will contribute to Åbro Bryggeri becoming completely self-sufficient in solar. The park is planned to be commissioned during the latter part of 2022.

CEO letter

Another year of strong growth

When we now summarize 2021, it is our third year in a row with strong growth after we began our acquisition strategy in 2019. We reach MSEK 951.8 from operations and deliver 91% growth at Group level, excluding revaluation effects from the special listing of Advanced Soltech of SEK 288 million. The Group's operating profit (EBIT) amounted to MSEK 150.7 (42.8), an increase of 252%.

Right now, we are experiencing very uncertain times globally with concerns about higher interest rates, inflation and even a war in the Ukraine. The severe and uncertain global situation affects us all, including our business. At the same time, it recalls the importance of reducing dependence on fossil energy sources and investing in long-term sustainable energy supplies such as solar energy. There, Soltech is ready to be a strong partner in the green energy transition.

Organic growth of 29%

Soltech is an acquisition-intensive company that delivers strong growth through this strategy. I am also very proud that in 2021 we had an organic growth of as much as 29% in the Group. It proves that we can not only acquire, but also help our existing companies to develop and grow.

The acquisition strategy resulted in ten new companies

Despite a tough year in the shadow of the corona pandemic, with a series of meeting restrictions, we managed to acquire as many as ten companies. We have for some time been looking for good companies in electrical engineering because that competence is crucial when it comes to solar energy. In 2021, we are therefore pleased to have acquired Provektor, Rams El and Neabgruppen.

Companies in four different industries create benefits

The basis for the construction of our group is solar energy companies. But right from the start, we realized the benefits of also owning companies in the roofing / sheet metal, facade and electrical engineering industries. These companies have the crucial expertise needed for a high-quality solar energy installation, and they have a wide range of customers who are happy to buy solar energy from them. In other words, we acquire both expertise and business opportunities and transform these companies into future companies.

The Corona pandemic's impact on Soltech

Unfortunately, the year 2021 was a difficult year in terms of human and business suffering throughout the world. Soltech has suffered from delivery difficulties, higher prices and not least increased sick leave, something that also followed a bit into 2022. Despite these obstacles, our employees have struggled and delivered a really strong year.

Advanced Soltech was listed separately

Soltech's subsidiary Advanced Soltech Sweden AB (ASAB), which conducts our operations in China, was listed on Nasdaq First North on 29 October. We are proud that ASAB now stands on its own two feet with a better opportunity to refinance its loans. Soltech now owns 29.35% of ASAB and in connection with the listing, a profit of MSEK 288 arose in the Group. We maintain an active ownership influence by continuing to remain on the board and I am positive about the company's development and future.

Soltech is strong

I would like to end by saying that Soltech is stronger than ever, and we look forward to continuing to deliver on our strategy and by building long-term values for our owners and at the same time contributing to a green energy transition.

Stefan Ölander

CEO

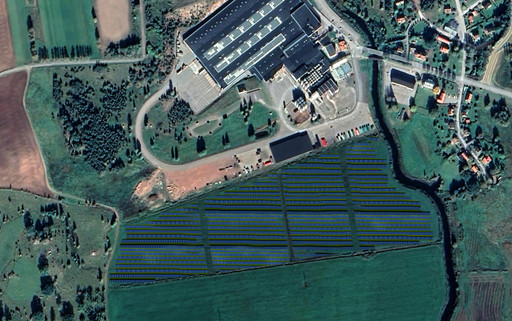

Sweden's largest solar park connected to one individual industry, Åbro Bryggeri in Vimmerby. The park will be built by Soltech Energy's subsidiary, Soltech Energy Solutions. The solar park will cover an area of 10 hectares and will make Åbro Bryggeri completely energy self-sufficient with solar power. The park is planned to be in full activity during the latter part of 2022.

Soltech Energy Solutions is a nationwide solar energy company in the Soltech Group that helps property owners, industries, and landowners with large-scale solar energy solutions. The company will now build what will be Sweden's largest solar park constructed for one individual actor, Åbro Bryggeri.

Åbro Solpark will be built in proximity of the brewery and will cover an area of approximately 100 000 square meters. The solar power production from the park will be used directly by the brewery and this climate investment will make Åbro completely self-sufficient of energy.

– Åbro Bryggeri is making an extraordinary solar energy investment with a 100 000 square meter solar park that is being built right next to the brewery. It is a well-established family business with impressive sustainability ambitions, and we are very happy to once again have the confidence to help them with large-scale solar energy installations, says Rickard Lantz, Business Development Manager at Soltech Energy Solutions.

An area of over 14 football fields

Since 2018, the brewery has also had a roof-mounted solar energy solution of 3,500 square meters that covered approximately 5 percent of the business's annual energy needs, also built by Soltech.

Now that Åbro Solpark is to be built, the solar energy from both the roof and the solar park will abundantly cover the brewery's energy needs. Åbro Solpark will be 10 hectares in size, which corresponds to just over 14 full-size football fields and will deliver over 8,000,000 kWh to Åbro's operations.

– Sustainability efforts is with us in everything we do at Åbro Bryggeri. Investing in a solar park that enables us to become completely self-sufficient in solar and at the same time further reduce our climate footprint is a natural step for us in that work. We want to thank Soltech for a good collaboration, says Henrik Dunge, CEO of Åbro Bryggeri.